We suggest that the advance in gold has long had fundamental rationale based on the central bank- manufactured underpinnings of the stock market advance, especially since 2011. A skyscraper that was built not of concrete and steel, but plywood and plaster. Now undone, especially in various major sectors: banks, autos, energy, etc. And with massive renewed monetary response by CBs. Fuel for gold.

There is the potential that what just happened to oil (absence of bids) could happen in reverse to gold — an absence of offers! Such a technical event would not surprise us. And if it occurs it will probably be associated with an ambush-type news story.

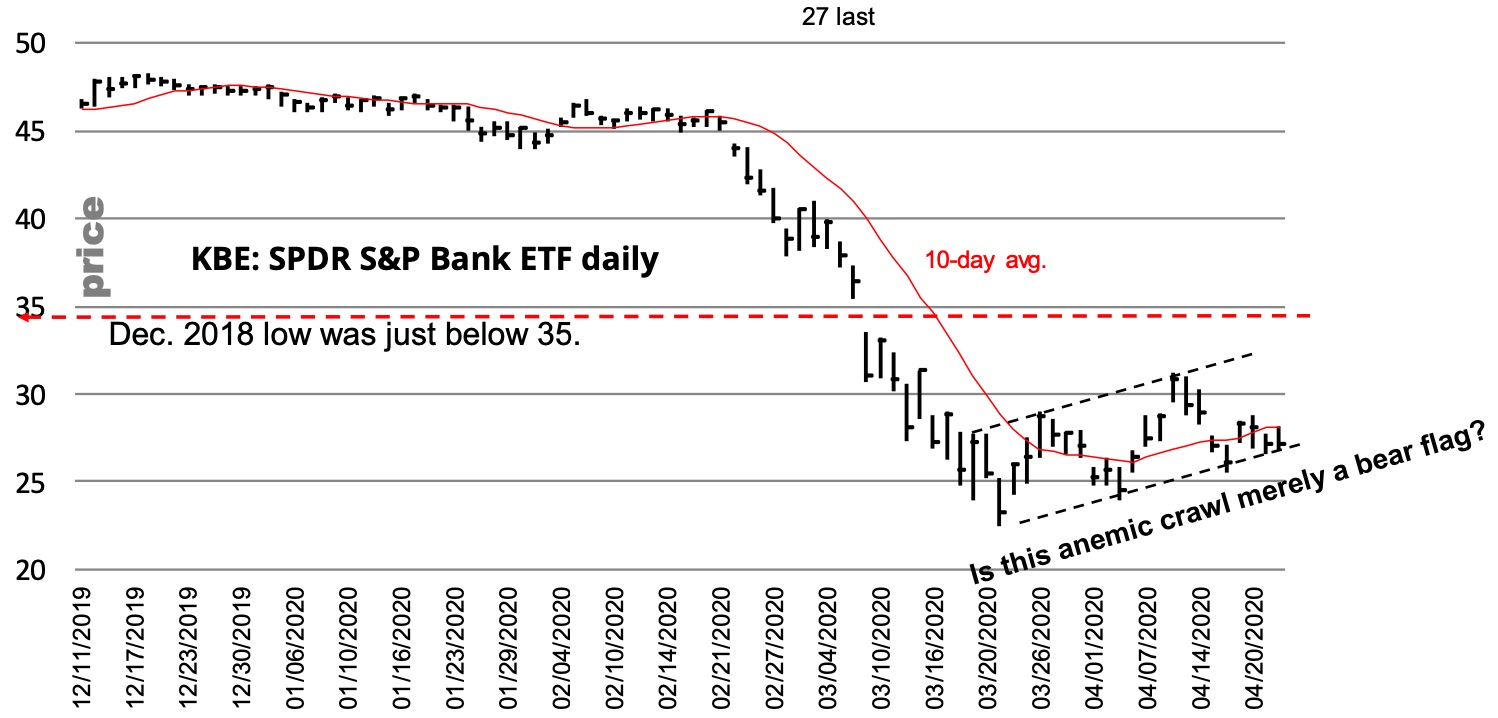

Perhaps one that comes from European or U.S. bank sectors. We shall see. This is a thought based on technical and fundamental factors.

- Source, Michael Oliver via King World News