- Source, Kitco News

TRACKING THE GOLD AND SILVER INVESTMENT COMMUNITY, WORLDWIDE - AN UNOFFICIAL EDITING OF RELATED INVESTMENT COMMENTARY

Friday, February 28, 2020

Why Can't Gold Go to $10000 per Oz?

Whistleblower Claims Corrupt Cover Up Of Dangerous Coronavirus Quarantines

A complaint filed with Health and Human Services (HHS) and promptly leaked to the New York Times alleges that federal health employees interacted with Americans quarantined for possible coronavirus exposure without proper medical training or protective gear, and that health agency leaders engaged in a 'corrupt cover-up' when staff members complained, according to the Times.

Filed with the Office of the Special Counsel, a whistleblower described as a 'senior leader' at HHS said the team was "improperly deployed" to two California military bases to assist with processing American evacuees fromcoronavirus hot zones in China and elsewhere.

The staff members were sent to Travis Air Force Base and March Air Reserve Base and were ordered to enter quarantined areas, including a hangar wherecoronavirus evacuees were being received. They were not provided training in safety protocols until five days later, the person said.

Without proper training or equipment, some of the exposed staff members moved freely around and off the bases, with at least one person staying in a nearby hotel and leaving California on a commercial flight. Many were unaware of the need to test their temperature three times a day. -New York Times

"I soon began to field panicked calls from my leadership team and deployed staff members expressing concerns with the lack of H.H.S.communication and coordination, staff being sent into quarantined areas without personal protective equipment, training or experience in managing public health emergencies, safety protocols and the potential danger to both themselves and members of the public they come into contact with," reads the complaint, which HHS has acknowledged receiving.

"We take all whistle-blower complaints very seriously and are providing the complainant all appropriate protections under the Whistleblower Protection Act," said deputy assistant secretary Caitlin B. Oakley, who is also the department's national spokeswoman for the Office of the Assistant Secretary of Public Affairs. "We are evaluating the complaint and have nothing further to add at this time."

The Times notes that the complaint comes right after President Trump began to downplay the risks ofcoronavirus on US soil "amid bipartisan concern about a sluggish and disjointed response by the administration to an illness that public health officials have said is likely to spread through the United States."

In other words, thecoronavirus response officially an election issue now.

The whistle-blower’s account raised questions about whether the Trump administration has taken adequate precautions in its handling of the virus to date, and whether Mr. Trump’s minimization of the risks has been mirrored by other top officials when confronted with potentially disturbing developments. -New York Times

The first American case ofcoronavirus emerged neary Travis Air Force Base this week in an American patient with no known contact with hot zones or other coronavirus patients.

The Times also reports that similar incidents 'appear to have happened elsewhere,' pointing to HHS employees were also dispatched to Marine Corps Air Station Miramar to help evacuees from Wuhan, China "someone with direct knowledge of the effort" leaked.

The levels of protection varied even while he was at Miramar, he said. Standards were more lax at first, but once people arrived who appeared to be sick, workers began donning personal protective equipment. He is now back at work, and has yet to be tested forcoronavirus exposure.

In the complaint, the whistle-blower painted a grim portrait of agency staff members who found themselves on the front lines of a frantic federal effort to confront thecoronavirus in the United States without any preparation or training, and whose own health concerns were dismissed by senior administration officials as detrimental to staff “morale.” They were “ admonished,” the complaint said, and “accused of not being team players,” and had their “mental health and emotional stability questioned.”

After a phone call with health agency leaders to raise their fears about exposure to the virus, the staff members described a “whitewashing” of the situation, characterizing the response as “corrupt” and a “cover-up,” according to the complaint, and telling the whistle-blower that senior officials had treated them as a “nuisance” and did not want to hear their worries about health and safety. - New York Times

California Democratic Rep. Jimmy Gomez, whose office received the complaint, appeared to reference it during a Thursday morning hearing with HHS secretary Alex M.Azar in the House Ways and Means Committee. Gomez was contacted by the whistleblower, who he had met before entering Congress, due in part because his committee has jurisdiction over HHS.

"To your knowledge, were any of the ACF employees exposed to high-risk evacuees from China?" Gomez asked Azar during a tense exchange.

"They should never have been, without appropriate PPE,"Azar responded - referring to 'personal protective equipment' used to protect workers from disease. "If you were anyone in quarantine, to maintain quarantine, that should be the case."

Gomez claimed that the teams sent to March and Travis air bases dealt with a "chaotic" situation.

Filed with the Office of the Special Counsel, a whistleblower described as a 'senior leader' at HHS said the team was "improperly deployed" to two California military bases to assist with processing American evacuees from

The staff members were sent to Travis Air Force Base and March Air Reserve Base and were ordered to enter quarantined areas, including a hangar where

Without proper training or equipment, some of the exposed staff members moved freely around and off the bases, with at least one person staying in a nearby hotel and leaving California on a commercial flight. Many were unaware of the need to test their temperature three times a day. -New York Times

"I soon began to field panicked calls from my leadership team and deployed staff members expressing concerns with the lack of H.H.S.

"We take all whistle-blower complaints very seriously and are providing the complainant all appropriate protections under the Whistleblower Protection Act," said deputy assistant secretary Caitlin B. Oakley, who is also the department's national spokeswoman for the Office of the Assistant Secretary of Public Affairs. "We are evaluating the complaint and have nothing further to add at this time."

The Times notes that the complaint comes right after President Trump began to downplay the risks of

In other words, the

The whistle-blower’s account raised questions about whether the Trump administration has taken adequate precautions in its handling of the virus to date, and whether Mr. Trump’s minimization of the risks has been mirrored by other top officials when confronted with potentially disturbing developments. -New York Times

The first American case of

The Times also reports that similar incidents 'appear to have happened elsewhere,' pointing to HHS employees were also dispatched to Marine Corps Air Station Miramar to help evacuees from Wuhan, China "someone with direct knowledge of the effort" leaked.

The levels of protection varied even while he was at Miramar, he said. Standards were more lax at first, but once people arrived who appeared to be sick, workers began donning personal protective equipment. He is now back at work, and has yet to be tested for

In the complaint, the whistle-blower painted a grim portrait of agency staff members who found themselves on the front lines of a frantic federal effort to confront the

After a phone call with health agency leaders to raise their fears about exposure to the virus, the staff members described a “whitewashing” of the situation, characterizing the response as “corrupt” and a “cover-up,” according to the complaint, and telling the whistle-blower that senior officials had treated them as a “nuisance” and did not want to hear their worries about health and safety. - New York Times

California Democratic Rep. Jimmy Gomez, whose office received the complaint, appeared to reference it during a Thursday morning hearing with HHS secretary Alex M.

"To your knowledge, were any of the ACF employees exposed to high-risk evacuees from China?" Gomez asked Azar during a tense exchange.

"They should never have been, without appropriate PPE,"

Gomez claimed that the teams sent to March and Travis air bases dealt with a "chaotic" situation.

- Source, Zero Hedge

Wednesday, February 26, 2020

The Bull Trap Syndrome, With Tony Locantro

- Source, Walk the World

Globalism Run Amuck: EU Officials Refuse To Implement Border Controls To Stop Coronavirus

Even as the coronavirus begins to spread around the continent, EU officials have steadfastly refuse to implement border controls, insisting that the sanctity of open borders is more important.

The number of confirmed cases in Italy has soared from 3 to 322 in the space of just five days, with 10 deaths, but authorities insist that the Schengen Area, which abolishes passport checks and border controls between 26 European states, must not be compromised.s Needs a Coherent, Coordinated Response: EU Health C

French transport minister Jean-Baptiste Djebbari has also refused to close the border between France and Italy. Germany has likewise refused to do so.

European commissioner for health Stella Kyriakides also said borders should remain open while suggesting that the threat of “disinformation” was more of a concern.

At what point does stopping an immensely dangerous and disruptive global pandemic become more important than the sacred, never to be questioned or curtailed “international flow of people”?

Numerous nearby countries have closed their border with China yet infected Chinese citizens are still flowing into the west.

The World Health Organization, whose job it is to stop a global pandemic, has repeatedly insisted that preventing stigmatization and keeping borders open is critical, to the point where they seem more concerned about that than actually stopping the pandemic.

Now that the coronavirus is beginning to impact the global economy and interrupt supply chains, is that prioritization going to come back to haunt them?

The number of confirmed cases in Italy has soared from 3 to 322 in the space of just five days, with 10 deaths, but authorities insist that the Schengen Area, which abolishes passport checks and border controls between 26 European states, must not be compromised.s Needs a Coherent, Coordinated Response: EU Health C

French transport minister Jean-Baptiste Djebbari has also refused to close the border between France and Italy. Germany has likewise refused to do so.

European commissioner for health Stella Kyriakides also said borders should remain open while suggesting that the threat of “disinformation” was more of a concern.

At what point does stopping an immensely dangerous and disruptive global pandemic become more important than the sacred, never to be questioned or curtailed “international flow of people”?

Numerous nearby countries have closed their border with China yet infected Chinese citizens are still flowing into the west.

The World Health Organization, whose job it is to stop a global pandemic, has repeatedly insisted that preventing stigmatization and keeping borders open is critical, to the point where they seem more concerned about that than actually stopping the pandemic.

Now that the coronavirus is beginning to impact the global economy and interrupt supply chains, is that prioritization going to come back to haunt them?

- Source, Zerohedge

Monday, February 24, 2020

Buffett is Bullish on Stocks but Says the Market Can Drop 50%

Stock market investors are watching the coronavirus spreading far beyond China.

It is no longer mostly in Asia. Italy has reported six coronavirus deaths and an accelerating number of cases. At a time like this, it is nice to see Berkshire Hathaway’s BRK.B, -2.92% Warren Buffett assuage investors. Buffett‘s advice — don’t buy or sell on the headlines — is especially applicable now.

There is a gem in Buffett’s annual letter, which was released over the weekend, that nobody is talking about. He writes: “Anything can happen to stock prices tomorrow. Occasionally, there will be major drops in the market, perhaps of 50% magnitude or even greater.” He continues that the combination of what he calls “The American Tailwind” and “compounding wonders” will make equities “the much better long-term choice for the individual who does not use borrowed money and who can control his or her emotions. Others? Beware!”

It is no longer mostly in Asia. Italy has reported six coronavirus deaths and an accelerating number of cases. At a time like this, it is nice to see Berkshire Hathaway’s BRK.B, -2.92% Warren Buffett assuage investors. Buffett‘s advice — don’t buy or sell on the headlines — is especially applicable now.

There is a gem in Buffett’s annual letter, which was released over the weekend, that nobody is talking about. He writes: “Anything can happen to stock prices tomorrow. Occasionally, there will be major drops in the market, perhaps of 50% magnitude or even greater.” He continues that the combination of what he calls “The American Tailwind” and “compounding wonders” will make equities “the much better long-term choice for the individual who does not use borrowed money and who can control his or her emotions. Others? Beware!”

- Source, Market Watch

Saturday, February 22, 2020

Thursday, February 20, 2020

Counter Intelligence Expert: There is a Brutal Deep State War Inside the US Government

The one investigation I think is going to happen, and then one investigation that will lead to indictments, is the investigation into Hunter Biden and his role in Ukraine and not just Ukraine, but his role in China and the $1.5 billion given to Hunter Biden’s company.

We will see some indictments there, but there is a war within the Deep State. This has been going on since Trump was elected. The Deep State is going crazy, and the rats are jumping off the ship. This is what I love about President Trump.

No President has confronted the Deep State in history like Donald Trump with the exception of JFK, and that did not work out well for him.” As far as the so-called whistleblower that started the impeachment hoax, Shipp says, “Call him in.

He is not a whistleblower, period. The evidence is there that he is not. Bring him in and question him because he was an operational plant originally put in the White House under John Brennan (former CIA Director) under Obama.

He was back in the White House in the Trump Administration, and they missed him, and then he engaged in an operation against the President of the United States with a false whistleblower report.”

The whistleblower’s boss, CIA Director Gina Haspel, is in on the operation and impeachment hoax, according to Shipp.

Shipp says, “Haspel would have taken administrative penalties against him. She would have come out publicly and decried what he did, and she has done none of that. In my opinion, it indicates she is supporting it, yes.”

- Source, USA Watchdog

Wednesday, February 19, 2020

What You Don't Know Will Bankrupt You: Understanding the Pension Cartoon

- Source, Real Vision Finance

Tuesday, February 18, 2020

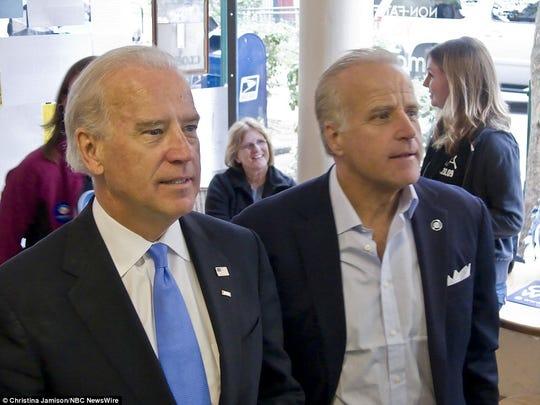

FBI Raids Business Tied To James Biden Influence Peddling

The FBI raided the home of a CEO of a bankrupt hospital chain last month along with one of its Pennsylvania hospitals central to influence-peddling accusations against Joe Biden's brother, James, according to RealClearInvestigations.

The CEO, Grant White, was accused in a Kentucky bankruptcy court filing by the trustee of having "grossly mismanaged" Florida-based Americore holdings, which acquires and manages rural hospitals. According to the filing, White "has not operated the hospitals in a manner that is consistent with public safety," and "improperly siphoned money from the Debtors for his personal benefit."

In December, the firm declared bankruptcy. On January 29, the FBI raided White's home, and one of Americore's hospitals - Ellwood City Medical Center, the next day. One week later, the Kentucky court granted a motion to remove White as CEO.

The Biden connection

Last Summer, White and James Biden were accused of fraud in a lawsuit, along with Biden's partner, hedge fund manager Michael Lewitt.

The lawsuit, filed by Tennessee businessman Michael Frey and his partner Dr. Mohannad Azzam, owners of Diverse Medical Management, also named Amer Rustom, another investor in Americore along with Biden and Lewitt.

The lawsuit alleges that James Biden had a prominent role in the company. One exhibit filed in the lawsuit is a photograph of an Americore business card that Biden reportedly handed out listing him as a “principal” in the company.

Frey alleges that when Diverse Medical Management and Americore were in talks to merge, Jim Biden promised to exploit his brother’s political influence as vice president to attract international investors and make the venture successful. -RCI

"Jim [Biden] told me. Don’t worry every time someone threatens to sue you you’re with us now nobody is gonna touch you," Lewitt allegedly bragged over a text message to Frey, who says he was worried about legal liability to his firm over an acquisition.

"It was Frey’s understanding that Lewitt was implying that DMM [Diverse Medical Management] was 'protected' because of Jim Biden’s connections."

The lawsuit also alleges that after failing to deliver on several promises made to Frey and Azzam, Biden took control of their dealings with Americore. “Biden instructed that Plaintiffs should no longer speak with Americore and White, but instead should deal exclusively with the Investor Defendants and their respective agents going forward, who would ensure that Plaintiffs’ model would find its way into hospitals and thrive,” the lawsuit says. -RCI

Biden and the other defendants are accused of pushing Frey and Azzam to take out loans for the purchase of failing rural hospitals they wanted to revive - based on assurances that they would be paid back when Biden helped secure investments from one of Turkey's largest conglomerates, Dogan Holding.

According to the lawsuit, Biden inadvertently texted Frey and revealed his plans to take over Diverse Medical Management and cut out Frey and Azzam.

"We can wrap [Americore] into Frey’s entity further diluting them both in the process? After we take control of both. Just a thought. We must have complete control, too many moving pieces. Jim," the text reportedly read.

Prior to filing their lawsuit, Diverse Medical Management says it was unable to make payroll.

A Biden spokesman disputed the claims last August, saying "It is nothing more than a cynical attempt to manipulate the press by taking advantage of Jim Biden’s public profile as the brother of a presidential candidate."

The raids were not the first time the FBI has investigated matters related to Americore. It got involved last August when, soon after the lawsuit was filed, Frey received an envelope at his home containing a thinly veiled threat. “Inside the envelope was what appeared to be blood-stained currency from a Middle Eastern country commonly known as a haven for terror groups and a 'torture ticket' — a voucher for the infliction of torture,” according to Knox News, which reviewed the contents of the envelope. -RCI

James was a frequent guest at the White House when Joe was Vice President and scored invites to important state functions which often "dovetailed with his overseas business dealings," such as the case of construction management firm subsidiary HillStone International, according to journalist Peter Schweizer.

On November 4, 2010, according to White House visitors’ logs, Justice visited the White House and met with Biden adviser Michele Smith in the Office of the Vice President.

Less than three weeks later, HillStone announced that James Biden would be joining the firm as an executive vice president. James appeared to have little or no background in housing construction, but that did not seem to matter to HillStone. -Peter Schweizer, via NY Post

According to Fox Business's Charlie Gasparino in 2012, HillStone's Iraq project was expected to "generate $1.5 billion in revenues over the next three years," more than tripling their revenue.

We can only imagine how disappointed James and the rest of the Biden brothers are at Joe's sagging poll numbers.

The CEO, Grant White, was accused in a Kentucky bankruptcy court filing by the trustee of having "grossly mismanaged" Florida-based Americore holdings, which acquires and manages rural hospitals. According to the filing, White "has not operated the hospitals in a manner that is consistent with public safety," and "improperly siphoned money from the Debtors for his personal benefit."

In December, the firm declared bankruptcy. On January 29, the FBI raided White's home, and one of Americore's hospitals - Ellwood City Medical Center, the next day. One week later, the Kentucky court granted a motion to remove White as CEO.

The Biden connection

Last Summer, White and James Biden were accused of fraud in a lawsuit, along with Biden's partner, hedge fund manager Michael Lewitt.

The lawsuit, filed by Tennessee businessman Michael Frey and his partner Dr. Mohannad Azzam, owners of Diverse Medical Management, also named Amer Rustom, another investor in Americore along with Biden and Lewitt.

The lawsuit alleges that James Biden had a prominent role in the company. One exhibit filed in the lawsuit is a photograph of an Americore business card that Biden reportedly handed out listing him as a “principal” in the company.

Frey alleges that when Diverse Medical Management and Americore were in talks to merge, Jim Biden promised to exploit his brother’s political influence as vice president to attract international investors and make the venture successful. -RCI

"Jim [Biden] told me. Don’t worry every time someone threatens to sue you you’re with us now nobody is gonna touch you," Lewitt allegedly bragged over a text message to Frey, who says he was worried about legal liability to his firm over an acquisition.

"It was Frey’s understanding that Lewitt was implying that DMM [Diverse Medical Management] was 'protected' because of Jim Biden’s connections."

The lawsuit also alleges that after failing to deliver on several promises made to Frey and Azzam, Biden took control of their dealings with Americore. “Biden instructed that Plaintiffs should no longer speak with Americore and White, but instead should deal exclusively with the Investor Defendants and their respective agents going forward, who would ensure that Plaintiffs’ model would find its way into hospitals and thrive,” the lawsuit says. -RCI

Biden and the other defendants are accused of pushing Frey and Azzam to take out loans for the purchase of failing rural hospitals they wanted to revive - based on assurances that they would be paid back when Biden helped secure investments from one of Turkey's largest conglomerates, Dogan Holding.

According to the lawsuit, Biden inadvertently texted Frey and revealed his plans to take over Diverse Medical Management and cut out Frey and Azzam.

"We can wrap [Americore] into Frey’s entity further diluting them both in the process? After we take control of both. Just a thought. We must have complete control, too many moving pieces. Jim," the text reportedly read.

Prior to filing their lawsuit, Diverse Medical Management says it was unable to make payroll.

A Biden spokesman disputed the claims last August, saying "It is nothing more than a cynical attempt to manipulate the press by taking advantage of Jim Biden’s public profile as the brother of a presidential candidate."

The raids were not the first time the FBI has investigated matters related to Americore. It got involved last August when, soon after the lawsuit was filed, Frey received an envelope at his home containing a thinly veiled threat. “Inside the envelope was what appeared to be blood-stained currency from a Middle Eastern country commonly known as a haven for terror groups and a 'torture ticket' — a voucher for the infliction of torture,” according to Knox News, which reviewed the contents of the envelope. -RCI

James was a frequent guest at the White House when Joe was Vice President and scored invites to important state functions which often "dovetailed with his overseas business dealings," such as the case of construction management firm subsidiary HillStone International, according to journalist Peter Schweizer.

On November 4, 2010, according to White House visitors’ logs, Justice visited the White House and met with Biden adviser Michele Smith in the Office of the Vice President.

Less than three weeks later, HillStone announced that James Biden would be joining the firm as an executive vice president. James appeared to have little or no background in housing construction, but that did not seem to matter to HillStone. -Peter Schweizer, via NY Post

According to Fox Business's Charlie Gasparino in 2012, HillStone's Iraq project was expected to "generate $1.5 billion in revenues over the next three years," more than tripling their revenue.

We can only imagine how disappointed James and the rest of the Biden brothers are at Joe's sagging poll numbers.

- Source, Zero Hedge

Monday, February 17, 2020

The Fed is Desperate to Stop a Recession, Crash Coming?

Of course Powell claimed they weren't using QE recently when they clearly were. The world is facing an everything bubble the likes of which we've never seen and the currencies of the world are all facing crisis.

Interest rates are falling and central banks are attempting to mitigate in anyway they can.

The recession never ended, it's just been papered over, but what comes next is far more epic than what we saw prolonged from 2008.

Sunday, February 16, 2020

The Eternal Relationship Between Gold and Global Crisis

Though it is often referred to by critics and elitist central bankers as a “barbaric relic”, there is no denying that gold is usually the go-to asset during times of crisis and uncertainty. And as much as they pretend to hate it, even the elites secretly stock the precious metal whenever the economy goes awry. In fact, you can almost predict when things will go bad simply by watching how much gold central banks around the globe stockpile in a particular year.

As noted in my last article, the banking establishment is often privy to impending disasters, usually because they directly participate in creating them. This is why they always seem to know when to prepare and hedge their assets to weather the storm. Gold is the hedge of choice because it is tangible, naturally rare, and cannot be artificially recreated or cloned. Governments and banks always seek to hoard gold when instability erupts because it not only shields their assets from decline, but it also shields their position of power.

In a world where the majority of the population is on the verge of poverty, those with an unbreakable economic position backed by hard assets tend to accumulate even more assets for pennies on the dollar, not to mention more political and social control. As the wealth gap grows wider, so does the power gap. It’s not that the elites have a personal use for all of these assets, they just don’t want YOU to have them.

Why? Because as hard assets and personal wealth are vacuumed up by the banks, they remove the concept of private property from the public consciousness, and thus, they destroy your independence. Pretty soon, the next generation has no idea what it means to own land, a home, commodities or precious metals. Eventually, they are living in a “shared economy” where they feel lucky just to have a pod apartment, Wi-Fi, and close access to public transit. The idea of building a home of their own for their children and grandchildren is lost. They may not ever start a family because of this. They are beholden to the state for everything.

As mentioned, the central bank pattern of wealth protection and then wealth usurpationis evident in their moves to scoop up gold at the perfect time just before a crisis. We can also see that in most cases after the gold standard was slowly removed and regardless of the crisis, gold prices tend to spike. In other words, most crisis events show central bank gold reserves jumping just before they happen, and prices on gold rally dramatically in response.

For example, in 1913 (the initial birth year of the Federal Reserve), central banks in multiple nations bought up gold at an accelerated pace leading up to the Crash of 1914, World War I, and into the Spanish Flu epidemic of 1918-1920. The U.S.added around 650 tons of gold to its reserves in 1913, then another thousand tons from 1915 to 1920.

Because of the gold standard and the peg to the dollar, the price did not fluctuate much at this time, but central bank holdings did. The economic crisis was so bad that the New York stock exchange closed for four months straight from July to November 1914. No event before or since has caused such a shutdown of markets. Gold was the primary investment hedge to protect wealth, and gold exports were curbed.

The same thing happened again as the world entered into the Great Depression of the 1930s. The Federal Reserve and the Treasury added around 2,700 tons of gold from 1930 to 1935, and then DOUBLED their reserves from 9,000 tons to 19,000 tons from 1935 to the start of World War II in 1939. The price of gold jumped from $20 an ounce to $35 an ounce from 1932 to 1934, though, at this time Franklin Roosevelt restricted the private ownership of gold through Executive Order 6102. This “ban” was not to be lifted officially for four decades. However, this did not stop gold from being widely traded on the black market.

The next dramatic event in the world of gold versus international crisis was in 1962 when the Cuban Missile Crisis triggered record demand for gold on the London market. Central banks utilized price suppression through the selling of reserves in a policy called “The Gold Pool”. You will find that this kind of price manipulation through selling is common when a price spike is not necessarily the idea of central banks. Such manipulation only works today as long as paper ETF markets and the physical markets remain coupled together. A large enough crisis has the power to break the paper to a physical relationship, and physicalmarkets then determine the price as the rush to safety accelerates.

Free market pricing of precious metals tends to have a short life span as central banks reassert their control of the market. Collecting profits during these windows is essential, and having a sense of timing is key.

In 1968, The Gold Pool was ended just as the Vietnam War was becoming an international breaking point and the Hong Kong Flu pandemic swept through multiple countries, killing over 1 million people. The Hong Kong Flu had a death rate of only 0.5%; compare that to the “official” death rate of the coronavirus at 2.2% (which is likely much higher than China is admitting to). At this time, gold saw a jump in price of around 22% and a high volume of central bank gold trading. That said, from that moment moving forward, central bank reserves began to slowly decline.

This trend has suddenly reversed in the past decade.

During the recession andinflationary crisis of 1978-1980, gold skyrocketed again, jumping 29% in 1978, 120% in 1979, and 29% again in 1980. During the crash of 1987, gold jumped 24%.

Another gold rally struck from 2002 to 2003, just after the collapse of the Dot Com Bubble, rising over 40% as the U.S.went to war with both Afghanistan and Iraq. It was also around this time that central banks began amassing gold reserves once again, but primarily among eastern nations like China and Russia. This gold buying spree has only expanded in recent years, with banks buying more gold in 2018 than they have in over five decades.

The next major gold market rally, triggered from 2009 to 2012, is well remembered by most of us. Prices jumped around 70% in total during the onset of the credit crash. This rally was thought to be thoroughly stifled by bank manipulation and many mainstream “experts” declared that gold would be dropping back well below $1,000 an ounce. In fact, these same experts have been predicting that gold would plunge below $1,000 every year for the past 7 years, and yet it has not.

Why? Again, because central banks are buying exponentially, and because the global economic system has been in a constant state of distress since the crash of 2008. Gold prices are not going to drop back to pre-crisis levels when our economy is perpetually unstable and none of the problems from 2008 have been fixed.

As the Federal Reserve began raising interest rates and cutting its balance sheet over the past couple of years, the mainstream economic mediawas certain that gold would plummet, but what they did not understand was the nature of gold during a crisis. As the Fed tightened liquidity into economic weakness, volatility returned with a vengeance to markets, fundamentals like manufacturing and real GDP began to plummet, and like clockwork, gold began to rocket upwards again.

Gold rallied from $1,200 in September of 2018 to nearly $1,600 in the span of a year, and central banks are continuing to buy regardless of the price increases. They seem to know something that most of us only suspect…

With the historic trends displayed plainly here, it is easy to predict what will happen next. Thecoronavirus outbreak is about to be labeled an official pandemic. The Fed’s repo market stimulus has failed to quell liquidity issues within the U.S. banking system, U.S. corporate debt and consumer debt is at all-time highs, the UK has just left the European Union with a No Deal Brexit (as I predicted they would in March of last year), and the U.S. is initiating a troop buildup in the Middle East to surround Iran. Not since World War I have we seen so many crisis events happening simultaneously.

It only makes sense that gold will once again become the premier asset for defending your savings. Remember, central banks are stockpiling the precious metal for a reason.

As noted in my last article, the banking establishment is often privy to impending disasters, usually because they directly participate in creating them. This is why they always seem to know when to prepare and hedge their assets to weather the storm. Gold is the hedge of choice because it is tangible, naturally rare, and cannot be artificially recreated or cloned. Governments and banks always seek to hoard gold when instability erupts because it not only shields their assets from decline, but it also shields their position of power.

In a world where the majority of the population is on the verge of poverty, those with an unbreakable economic position backed by hard assets tend to accumulate even more assets for pennies on the dollar, not to mention more political and social control. As the wealth gap grows wider, so does the power gap. It’s not that the elites have a personal use for all of these assets, they just don’t want YOU to have them.

Why? Because as hard assets and personal wealth are vacuumed up by the banks, they remove the concept of private property from the public consciousness, and thus, they destroy your independence. Pretty soon, the next generation has no idea what it means to own land, a home, commodities or precious metals. Eventually, they are living in a “shared economy” where they feel lucky just to have a pod apartment, Wi-Fi, and close access to public transit. The idea of building a home of their own for their children and grandchildren is lost. They may not ever start a family because of this. They are beholden to the state for everything.

As mentioned, the central bank pattern of wealth protection and then wealth usurpation

For example, in 1913 (the initial birth year of the Federal Reserve), central banks in multiple nations bought up gold at an accelerated pace leading up to the Crash of 1914, World War I, and into the Spanish Flu epidemic of 1918-1920. The U.S.

Because of the gold standard and the peg to the dollar, the price did not fluctuate much at this time, but central bank holdings did. The economic crisis was so bad that the New York stock exchange closed for four months straight from July to November 1914. No event before or since has caused such a shutdown of markets. Gold was the primary investment hedge to protect wealth, and gold exports were curbed.

The same thing happened again as the world entered into the Great Depression of the 1930s. The Federal Reserve and the Treasury added around 2,700 tons of gold from 1930 to 1935, and then DOUBLED their reserves from 9,000 tons to 19,000 tons from 1935 to the start of World War II in 1939. The price of gold jumped from $20 an ounce to $35 an ounce from 1932 to 1934, though, at this time Franklin Roosevelt restricted the private ownership of gold through Executive Order 6102. This “ban” was not to be lifted officially for four decades. However, this did not stop gold from being widely traded on the black market.

The next dramatic event in the world of gold versus international crisis was in 1962 when the Cuban Missile Crisis triggered record demand for gold on the London market. Central banks utilized price suppression through the selling of reserves in a policy called “The Gold Pool”. You will find that this kind of price manipulation through selling is common when a price spike is not necessarily the idea of central banks. Such manipulation only works today as long as paper ETF markets and the physical markets remain coupled together. A large enough crisis has the power to break the paper to a physical relationship, and physical

Free market pricing of precious metals tends to have a short life span as central banks reassert their control of the market. Collecting profits during these windows is essential, and having a sense of timing is key.

In 1968, The Gold Pool was ended just as the Vietnam War was becoming an international breaking point and the Hong Kong Flu pandemic swept through multiple countries, killing over 1 million people. The Hong Kong Flu had a death rate of only 0.5%; compare that to the “official” death rate of the coronavirus at 2.2% (which is likely much higher than China is admitting to). At this time, gold saw a jump in price of around 22% and a high volume of central bank gold trading. That said, from that moment moving forward, central bank reserves began to slowly decline.

This trend has suddenly reversed in the past decade.

During the recession and

Another gold rally struck from 2002 to 2003, just after the collapse of the Dot Com Bubble, rising over 40% as the U.S.

The next major gold market rally, triggered from 2009 to 2012, is well remembered by most of us. Prices jumped around 70% in total during the onset of the credit crash. This rally was thought to be thoroughly stifled by bank manipulation and many mainstream “experts” declared that gold would be dropping back well below $1,000 an ounce. In fact, these same experts have been predicting that gold would plunge below $1,000 every year for the past 7 years, and yet it has not.

Why? Again, because central banks are buying exponentially, and because the global economic system has been in a constant state of distress since the crash of 2008. Gold prices are not going to drop back to pre-crisis levels when our economy is perpetually unstable and none of the problems from 2008 have been fixed.

As the Federal Reserve began raising interest rates and cutting its balance sheet over the past couple of years, the mainstream economic media

Gold rallied from $1,200 in September of 2018 to nearly $1,600 in the span of a year, and central banks are continuing to buy regardless of the price increases. They seem to know something that most of us only suspect…

With the historic trends displayed plainly here, it is easy to predict what will happen next. The

It only makes sense that gold will once again become the premier asset for defending your savings. Remember, central banks are stockpiling the precious metal for a reason.

- Source, Silver Bear Cafe

Friday, February 14, 2020

Gold & Silver Update: Fed Chief Warns Congress

- Source, Golden Rule Radio

Wednesday, February 12, 2020

Nearly Half of Americans Say Rising Cost of Living is the Greatest Threat to Financial Security

- Source, Wall St for Main St

Tuesday, February 11, 2020

The Ultimate Gold Price Predictions: The Bull Consensus is Clear

The Ultimate Gold Panel consists of Frank Holmes, CEO of U.S. Investors, Rick Rule, president of Sprott U.S., Grant Williams of Vulpes Investment Management, and Peter Schiff, CEO of Euro Pacific Capital.

- Source, Kitco News

Sunday, February 9, 2020

What Do The US Jobs Numbers Really Mean For the Economy?

In this episode, Roger Hirst talks about how WTI crude oil has cratered over the past couple of weeks, the vulnerabilities it continues to face, and what would have to happen to indicate real risk in global growth. He also discusses the upcoming report for US non-farm payrolls.

After missing last month’s expectations, the January report’s expectations have accounted for deceleration in the US economy. However, if the January report shows a major movement in the new numbers, markets may react significantly. Finally, he reviews Disney’s earnings from this week.

- Source, Real Vision Finance

Friday, February 7, 2020

Craig Hemke: The Fed is Monetizing the Debt

That cash goes into the stock market and makes it keep going up, which they’ve got to have.

What people need to understand is this is madness , and it’s only going to get worse, and that is also why you have to own gold and silver.”

- Source, USA Watchdog

Wednesday, February 5, 2020

Ron Paul: Major Economic Crisis Coming, Blame the Fed and its Fiat Money

Central banking and the Fed have been a foolish attempt to break them.

One hundred years of folly is one hundred years too long! A major crisis is ahead, and the Fed is to blame.

- Source, Ron Paul

Monday, February 3, 2020

World Gold Council: The fuel behind central banks hunger for gold

“Central banks also cite safety and diversification in reasons why they invest in gold, and in some sense, gold is an asset that can protect their reserves over the long term,” Artigas told Kitco News.

- Source, Kitco News

Subscribe to:

Posts (Atom)