- Source, Wall St to Main St

TRACKING THE GOLD AND SILVER INVESTMENT COMMUNITY, WORLDWIDE - AN UNOFFICIAL EDITING OF RELATED INVESTMENT COMMENTARY

Monday, December 30, 2019

More Repo Madness and Not QE Grow Fed's Official Balance Sheet Over $400 Billion Dollars

Sunday, December 22, 2019

These Major Market Risks Have Not Gone Away, They May Blow Up

First of all, I think the valuations are a bit extended. I don’t think the market has truly factored in the Brexit issue. With Boris Johnson being elected, they are going to leave the EU, but it’s just not that easy,” Hug told Kitco News.

- Source, Kitco News

Friday, December 20, 2019

Ron Paul: Lying About Inflation Won’t Make It Go Away

- Source, Ron Paul

Wednesday, December 18, 2019

Alasdair Macleod: What Will the Developing Crisis Look Like?

Clearly, central banks will respond to the next credit crisis with an even greater expansion of money quantity than at the time of the Lehman crisis eleven years ago. The consequence of this monetary inflation seems certain to lead to an even greater rate of loss of purchasing power for fiat currencies than currently indicated by independent assessments of price inflation.

Monetary inflation is likely to be directed at resolving two broad problems: providing a safety net for the banks and big businesses, as well as funding rising government deficits. Therefore, the amount of quantitative easing, which will be central to satisfying these objectives, will soar.

The effect on markets will differ from being a rerun of the 1929–32 example in one key respect. Ninety years ago, the two major currencies, the dollar and sterling, were on a gold exchange standard, which meant that during the crisis asset and commodity prices were effectively measured in gold. Today, there is no gold backing and prices will be measured in expanding quantities of fiat currency.

Prices measured in fiat currencies will be determined ultimately by the course of monetary policy. But in real terms, the outlook is for a repeat of the conditions that afflicted markets and economies during and following the 1929 Wall Street crash. A further difference from the Depression years is that today Western governments have extensive legal obligations to provide their citizens with welfare, the cost of which is escalating in real terms. Add to this the cost of rising unemployment and a decline in tax revenue and we can see that government deficits and debts will increase rapidly even in a moderate recession.

This brings us to an additional problem, likely to be evident in a secondary phase of the credit crisis. As it becomes obvious that the purchasing power of fiat currencies is being undermined at a rate which is impossible to conceal through statistical methods, the discounted value of future money reflected in its time preference will rise irrespective of interest rate policy. Consequently, borrowers will be faced with rising interest rates to compensate for both increasing time preference and the additional loan risk faced by lending to different classes of borrowers.

Besides closing off virtually all debt financing for businesses and increasingly indebted consumers, this will play havoc with governments accustomed to borrowing atsuppressed or even negative interest rates. Prices for existing bonds will collapse, and banks loaded up with government debt to benefit from Basel Committee on Banking Supervision regulations will find their slender capital, if they have any left, quickly eroded.

The world of fiat currencies faces no less than its last hurrah. Indeed, some ofthe more prescient central bankers appear concerned the current system is running out of road, with the dollar as the world’s reserve currency no longer fit for this purpose. They want to find a means of resetting everything, exploring solutions such as digitising currency through blockchains , doing away with cash, and finding other avenues to try to control the so-called vagaries of free markets.

None of them will work, because even a new form of money will require inflation to rescue government finances and prevent financial and economic failure. The accelerating pace of monetary creation to address these problems will remain the one problem central to the failure of a system of credit and monetary creation: the impossibility of resolving the debt trap that has ensnared us all.

Just as Germany found in 1923, monetary inflation as a means of funding government and other economic liabilities is a process that rapidly gets out of its control. Eventually, people understand the debasement fraud and begin to dispose of the fiat currency as rapidly as possible. It then has no value.

The ending of the fiat currency regime is bound to terminate the repeating cycles of bank creditlegitimised since 1844. The socialism of money through inflationary debasement will be exposed as a massive fraud perpetrated on ordinary people.

Monetary inflation is likely to be directed at resolving two broad problems: providing a safety net for the banks and big businesses, as well as funding rising government deficits. Therefore, the amount of quantitative easing, which will be central to satisfying these objectives, will soar.

The effect on markets will differ from being a rerun of the 1929–32 example in one key respect. Ninety years ago, the two major currencies, the dollar and sterling, were on a gold exchange standard, which meant that during the crisis asset and commodity prices were effectively measured in gold. Today, there is no gold backing and prices will be measured in expanding quantities of fiat currency.

Prices measured in fiat currencies will be determined ultimately by the course of monetary policy. But in real terms, the outlook is for a repeat of the conditions that afflicted markets and economies during and following the 1929 Wall Street crash. A further difference from the Depression years is that today Western governments have extensive legal obligations to provide their citizens with welfare, the cost of which is escalating in real terms. Add to this the cost of rising unemployment and a decline in tax revenue and we can see that government deficits and debts will increase rapidly even in a moderate recession.

This brings us to an additional problem, likely to be evident in a secondary phase of the credit crisis. As it becomes obvious that the purchasing power of fiat currencies is being undermined at a rate which is impossible to conceal through statistical methods, the discounted value of future money reflected in its time preference will rise irrespective of interest rate policy. Consequently, borrowers will be faced with rising interest rates to compensate for both increasing time preference and the additional loan risk faced by lending to different classes of borrowers.

Besides closing off virtually all debt financing for businesses and increasingly indebted consumers, this will play havoc with governments accustomed to borrowing at

The world of fiat currencies faces no less than its last hurrah. Indeed, some of

None of them will work, because even a new form of money will require inflation to rescue government finances and prevent financial and economic failure. The accelerating pace of monetary creation to address these problems will remain the one problem central to the failure of a system of credit and monetary creation: the impossibility of resolving the debt trap that has ensnared us all.

Just as Germany found in 1923, monetary inflation as a means of funding government and other economic liabilities is a process that rapidly gets out of its control. Eventually, people understand the debasement fraud and begin to dispose of the fiat currency as rapidly as possible. It then has no value.

The ending of the fiat currency regime is bound to terminate the repeating cycles of bank credit

- Source, Alasdair Macleod via Mises

Tuesday, December 17, 2019

Repo Madness Is Global? BIS Warns of Looming EU Repo Problems

Yet this Bubble Dynamic is undoubtedly global, with international securities finance instrumental to inflating securities and asset markets around the world.

A Bloomberg article this week referenced a $9.0 TN European “repo” market. There are also large repo markets in Japan and throughout Asia.

How much finance used to leverage global securities is originating out of the likes of Hong Kong, Singapore and Shanghai - not to mention the Cayman Islands and Luxembourg? How much global “repo ” finance has been flowing into U.S. debt markets?

- Source, Wall St for Main St

Saturday, December 14, 2019

The FED is About to Erase Almost Two Years of QE in a Few Months

- Source, Silver Fortune

Friday, December 13, 2019

Unelected Power: Caging and Limiting Central Banks

Gold standard replaced by central banks must come with mandates of limit. Thanks for listening to this week's McAlvany Commentary.

- Source, Golden Rule Radio

Wednesday, December 11, 2019

Why QE is the Fed's Only Weapon Left

How does the Fed keep the markets going as asset prices continue to soar? Brigden explains the potential channels and methods of intervention and explores specific trades that may benefit in different environments.

- Source, Real Vision Finance

Monday, December 9, 2019

"Not QE" Announces Another Recession, Gold Whale Appears

Now, enter a GOLD WHALE on the COMEX who has staked a staggering long position and even rolled it forward, anticipating gold to make a major move.

Alasdair Macleod, Head of Research at GoldMoney, returns to Finance and Liberty to cut through the clutter of fake government statistics and misdirection of manipulated markets to remind us of the shocking parallels between today vs. the eve of the great crash of 1929...

- Source, Reluctant Preppers

Wednesday, December 4, 2019

Even Orwell Didn't Imagine the Dystopia of State Run Cryptocurrencies

- Source, Silver Fortune

Saturday, November 30, 2019

China is Threatening to Pop the Global Debt Bubble

- Source, Silver Fortune

Wednesday, November 27, 2019

Financial Crisis Might Be Best Thing to Happen to the Economy

This was a stunning revelation and the biggest auditing discovery in the history of accounting. This is being ignored by academia, government and the MSM, but you cannot pretend there will be no consequences forever. Dr. Skidmore says, “The financial crisis that may come in the near future may not be the worst thing.

That may be the best thing so we can reset and get a footing in reality and something that has integrity. I am concerned we won’t turn back and move in the right direction.

What does it mean to my children when a government can say we can just create fake books and pretend they are real? This sure looks like a giant fraud to me.

These unsupported adjustments are a sign of fraud. Why don’t we look?”

- Source, USA Watchdog

Monday, November 25, 2019

Peter Schiff: QE4 Sends Dow Above 28,000

Now, I'm sure everybody is getting their "Dow 30,000!" hats ready, because obviously that's not too far off, now from 28,000. But it's not just the Dow that is setting records and crossing milestones.

The NASDAQ - another record high today - up 61.81, closing at 8,540.83. That's the first time the NASDAQ has been above 8,500. The S&P also making new highs, up 23.83 - 3120.46 is the close . This is the first time the S&P has been above 3100.

- Source, Peter Schiff

Sunday, November 24, 2019

Jeff Snider: The Financial System Is Broken

Snider explains why this problem is not coming up out of the blue and breaks down why he views recent market moves as a sign that the banks are telegraphing their knowledge of major threats to the monetary system.

- Source, Real Vision Finance

Friday, November 22, 2019

Thursday, November 21, 2019

How the Fed Boosts the One Percent, as Told by the Fed

Even the upper middle class loses share of household wealth to the 1%. The bottom half gets screwed.

- Source, The Wolf Street Report

Wednesday, November 20, 2019

Craig Hemke: ECB Global Recession Crisis

- Source, Reluctant Preppers

Tuesday, November 19, 2019

Ignoring It Won't Make It Go Away: The Fed's Bubble Will Burst

The President has the same erroneous view. But ignoring the biggest bubble that the Fed has ever created will not make it go away.

- Source, Ron Paul

Monday, November 18, 2019

Thursday, November 14, 2019

Golden Opportunity: It Amazes Me How Bearish Gold Investors Have Become

Several months ago, back in early June, I notified those willing to listen that gold was preparing to “take off like a rocket-ship.” To my members of ElliottWaveTrader.net, I outlined my expectations for a strong rally to the 137 region, followed by a continued move to the 143/45 region before we see a larger consolidation. Thus far, the market has been reacting as generally expected.

In my last public metals article, I noted that the market was not providing us any signs that a bottom has been struck just yet. Rather, the rally we experienced in October was quite overlapping and did not satisfy my need to see a 5-wave rally to confirm that a bottom has already been struck.

So, in the last week of October, GLD provided us with a small degree 5-wave decline. That provided us advance warning that the next bout of weakness in the metals complex was

At this point in time, we are approaching my ideal target region.

But, what really amazes me is how bearish many have now become of the metals. I am reading many posts, blogs and articles which are starting to view this as a “fake rally.” Yet, I don’t think the structure of the metals market is supportive of that perspective.

The rally we have experienced over the last year has been quite

Therefore, as long as GLD remains over the 130/131 support region (and ideally over 133), my next target region is the 157-161 region.

But, before I am willing to trade that next rally aggressively, I am going to wait for the market to provide us with a clear 5-wave structure

In the meantime, I am looking for a local bottom to be struck in our gold price forecast over the coming week or two, and followed by a 5-wave rally off that low. That will then put us on warning to prepare for the next major rally phase over the coming months.

Lastly, the next time we see a 5-wave structure

For those that would like to understand this methodology a bit better, please feel free to read through the six-part series I penned on ElliottWaveTrader, which explains my methodology from the theoretical and technical perspectives.

- Source, Goldseek

Wednesday, November 13, 2019

Alasdair Macleod: Acute Failure of the Monetary System

Alasdair also gives us a report on the UK situation on the ground with the Brexit from the EU, and what it means for the Euro and the USD.

He further answers YOUR viewer questions about BOND REPOS, "Not QE," the phenomenon of multiple countries trying to repatriate their gold from the global exchanges, and the trade-offs between owning gold mining stocks vs. physical metal.

- Source, Reluctant Preppers

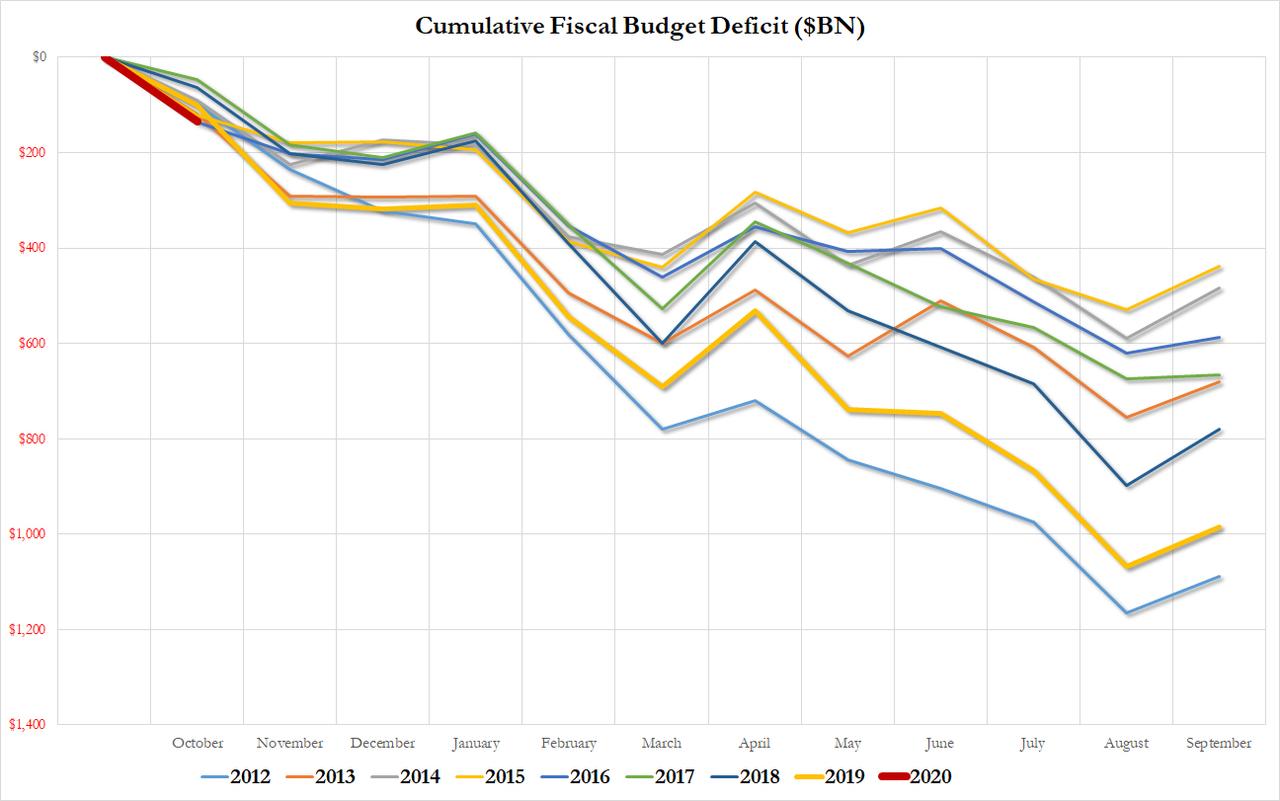

Worst In Five Years: October Budget Deficit Surges 34% To $134 Billion

One month after the Treasury reported that in fiscal 2019 the US budget deficit hit $984 billion, a 26% increase from a year earlier, and the largest annual deficit since 2012's $1.1 trillion, today the US Treasury released the latest monthly deficit data which revealed that in October, the first month of Fiscal 2020, the US deficit shortfall hit $134 billion, a $34 billion, or 34%, increase to the $100 billion deficit in October 2018, bigger than the average forecast of $130 billion.

October's deficit was the biggest in five years, just shy of the $136.5 billion in October 2015, and sets the US on the path to surpassing a $1 trillion deficit for the first time in eight years.

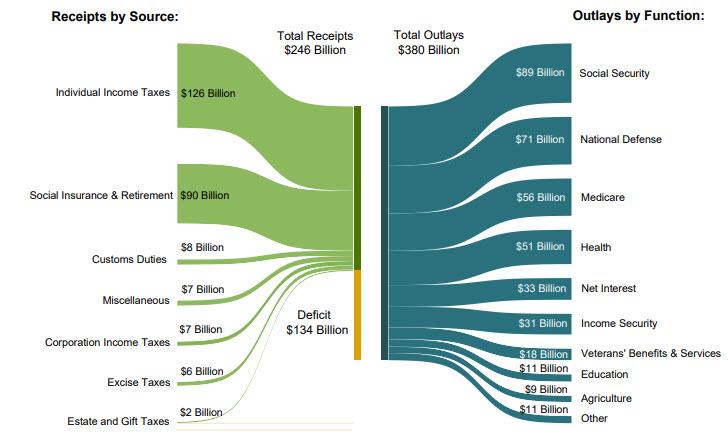

In the first month of fiscal 2020, income of $246billion dropped 2.8% from a year earlier, while spending of $380 billion jumped 7.6%. The biggest sources of income were individual income taxes ($126 billion), social insurance and retirement ($90 billion), while the biggest outlays were social security ($89 billion), national defense ($71 billion), medicare ($56 billion) and health ($51) billion, while the US Treasury spent $33 billion on interest on the Federal debt, roughly the same that it spent on veterans' benefits, education, and agriculture combined.

The monthly deficit would have been greater had Trump not imposed tariffs on Chinese goods: in October, customs duties boosted US revenue by $7.8 billion, up from $5.6 billion a year ago, and represents tariffs U.S.companies paid on imports of Chinese merchandise.

In October, the cumulative 12-month deficit gap hit 4.7% of GDP, the largest since May 2013. The US has not had a full-year budget surplus since 2001.

So far this year, the CBO's forecast is spot on: the budget office estimated the October deficit would be $133 billion, and it sees the total federal deficit topping $1 trillion in the current and 2021 fiscal years, about 5 % of GDP.

Addressing Congress earlier on Wednesday, Fed Chairman Jerome Powell said that "the federal budget is on an unsustainable path" that ultimately could limit lawmakers’ ability to support the economy in a downturn. During the question-and-answer period before the Joint Economic Committee, Powell said lawmakers can’t ignore deficits and that it’s important for the economy to grow faster than debt. Alas, one look at the CBO's long term debt forecast suggests that by that definition, the US is probably doomed...

October's deficit was the biggest in five years, just shy of the $136.5 billion in October 2015, and sets the US on the path to surpassing a $1 trillion deficit for the first time in eight years.

In the first month of fiscal 2020, income of $246

The monthly deficit would have been greater had Trump not imposed tariffs on Chinese goods: in October, customs duties boosted US revenue by $7.8 billion, up from $5.6 billion a year ago, and represents tariffs U.S.

In October, the cumulative 12-month deficit gap hit 4.7% of GDP, the largest since May 2013. The US has not had a full-year budget surplus since 2001.

So far this year, the CBO's forecast is spot on: the budget office estimated the October deficit would be $133 billion, and it sees the total federal deficit topping $1 trillion in the current and 2021 fiscal years, about 5 % of GDP.

Addressing Congress earlier on Wednesday, Fed Chairman Jerome Powell said that "the federal budget is on an unsustainable path" that ultimately could limit lawmakers’ ability to support the economy in a downturn. During the question-and-answer period before the Joint Economic Committee, Powell said lawmakers can’t ignore deficits and that it’s important for the economy to grow faster than debt. Alas, one look at the CBO's long term debt forecast suggests that by that definition, the US is probably doomed...

- Source, Zero Hedge

Many Indications Gold and Silver Prices Have Likely Bottomed

Tuesday, November 12, 2019

Has The Fiat Currency Crisis and Crack Up Boom Begun?

But what does this mean for the US dollar, fiat currencies, gold, silver, and the hyper-inflationary monetary death spiral that we're all about to not just bear witness to but also participate in?

- Source, Silver Doctors

Doug Casey: You Can Run But You Can't Hide

Doug Casey,

- Source, Reluctant Preppers

Monday, November 11, 2019

Behold the Gift of Gold...

"Where do you see Gold finishing the year?" Directed at yours truly came that question from across the square table at last Sunday's Investors Roundtable, the price of Gold then at 1517. The instinctive response with nary a thought (which is said to be the hallmark of a good trader and by our experience works some 50% of the time) was "Probably right about in here."

Not to have taken the wind out of the sails (let alone wiped drool off the lips) from those wanting to have instead heard the bandied-about figure of "1600", but 'tis what 'tis . We then lightly elaborated upon that which you valued readers have already come to know these many weeks: that subsequent to Gold having achieved our "aggressive" forecast high for this year of 1526 back on 12 August, (from which there were two swiftly -failed follow-throughs to the mid-1500s), price has been fairly range-bound, indeed congested throughout, within the high-1400s to low-1500s. You can see that by price's track in the above Gold Scoreboard ... until this week's lurch lower.

'Course with seven full trading weeks still remaining in 2019, the return toward our so-called "centerpiece price" of 1526 not only is viable but we think likely. In fact, this lurch lower -- which found Gold settling out the week yesterday (Friday) at 1460 -- one might regard as anticipated, healthy, and finally as having happened.

You know where we're going withthis but 'tis worth the repeat. And to put it in visual context , let's go straightaway with Gold's weekly bars from one year ago-to-date:

The now eight-week run of parabolic Short trend per the rightmost red dots kicked into lower gear back on 20 September. Since such date, you've herein regularly readof the 1454-1434 pricing area referred to as a support shelf -- its lavender rectangle added to the above graphic -- which Gold could well test during this parabolic Short trend. Recall, too, that 1434 had initially been our "conservative" forecast high for this year (achieved pre-dawn on 25 June whilst we were wifi'ing in Terminal 2 at Aeroport Nice Côte d'Azur ) from which price then floundered about for better than a month toward creating a resistance area before breaking out higher to 1526 . And you know the old tried-and-true traders' saying: resistance becomes support which is how we now view the 1454-1434 zone, Gold this past week coming within a whisker of testing it by trading down yesterday to as low as 1457.

Will the 1454-1434 support shelf stick? We ought think so. As of a week ago, Gold had been putting in its best year (+18%) since 2010 (+29%), but with this lurch lower is now tied with 2017's full-year performance 'round +14%. Still, there's no fundamental nor technical rationale to throw the baby out with the bathwater: markets ebb as well as flow. And per last week's missive, we're now working through Gold's "No-Go" from which we 'spect we'll move toward year's-end with "Go-Go" back up into the 1500s. But should 1434 materially fail, please have Santa present us with a dunce cap for Christmas. And better as a gift to yourself, this support shelf -- as we always caution given prudent cash management -- appears as a nice price area to buy Gold.

One might even dub Gold's having pulled in its reigns of late as "the pause that refreshes". For in next lookingto our graphic of Gold's daily closes since the highest ever at 1900 back in 2011, price upon embarking from our old nemesis "The Box" (1240-1280) this past June pretty much has gone straight up the lift shaft to now dawdle about, (just below the 1541 blue line from which the weekly parabolic trend would flip from Short to Long were that price remotely to be reached in the new week). But in looking at Gold per this broader context, 'tis been one heckova great run of late. Moreover, as that horizontal blue line mathematically moves lower week-by-week, such parabolic flip back to Long is certainly in play before the year is out, (barring the baby with the bathwater being thrown out):

'Course, 'tis all about riding the complacency wave of stocks. After all, they only go up, the S&P 500 hitting all-time highs in six of the past ten trading days. Even though the Federal Open Market Committee members are shying away from further rate allay. Even though with most constituents having reported their Q3 earnings, only 62% have beaten the like quarter of a year ago. Even though the mighty Index's "live" price/earnings ratio as honestly calculated is 33.5x. Even though the Economic Barometer -- which did have a better week -- nonetheless broadly has been working lower. Here's the Baro (blue line) year-over-year with the S&P (red line) wandering -- no, "rocketing" -- into deep space:

Yes, there were a few shining bulbs from the week just past: The Institute for Supply Management's October Services reading ticked higher for just the fourth month of this year's ten; and the Trade Deficit was reduced in September aswere Wholesale Inventories; all good, that. BUT: Mr. Stagflation reared his ugly head in Q3 as Unit Labor Costs rose +3.6% -- the most since Q2 for 2016 -- and Productivity fell -0.3%, the largest drop since that same Q2 back in 2016. And following those like 2016 reports, the S&P then slumped -5% that year from August through October. Just sayin'...

Not to have taken the wind out of the sails (let alone wiped drool off the lips) from those wanting to have instead heard the bandied-about figure of "1600", but '

'Course with seven full trading weeks still remaining in 2019, the return toward our so-called "centerpiece price" of 1526 not only is viable but we think likely. In fact, this lurch lower -- which found Gold settling out the week yesterday (Friday) at 1460 -- one might regard as anticipated, healthy, and finally as having happened.

You know where we're going with

The now eight-week run of parabolic Short trend per the rightmost red dots kicked into lower gear back on 20 September. Since such date, you've herein regularly read

Will the 1454-1434 support shelf stick? We ought think so. As of a week ago, Gold had been putting in its best year (+18%) since 2010 (+29%), but with this lurch lower is now tied with 2017's full-year performance 'round +14%. Still, there's no fundamental nor technical rationale to throw the baby out with the bathwater: markets ebb as well as flow. And per last week's missive, we're now working through Gold's "No-Go" from which we '

One might even dub Gold's having pulled in its reigns of late as "the pause that refreshes". For in next looking

'Course, '

Yes, there were a few shining bulbs from the week just past: The Institute for Supply Management's October Services reading ticked higher for just the fourth month of this year's ten; and the Trade Deficit was reduced in September as

- Source, deMeadville, read the full article here

How Much Lower Will Silver and Gold Go?

Sunday, November 10, 2019

The Real Drivers Behind Higher Gold Prices Are Yet to Come

“There are a lot of catalysts that have pushed gold to where they are now. We broke through that $1,400 ceiling and now the $1,400 seems to be the floor,” Clark told

“It’s not surprising that gold came a little weaker recently, but when you think about it, the big catalysts that are out there, that will drive gold and silver higher, haven’t even begun to play out yet.”

- Source, Kitco News

Saturday, November 9, 2019

Nick Barisheff: What Will Drive Gold to $10000?

- Source, Reluctant Preppers

Friday, November 8, 2019

The Wolf Report: What’s Behind the Fed’s Bailout of the Repo Market?

- Source, The Wolf Report

Thursday, November 7, 2019

Newfound Economic and Market Optimism A Warning?

On top of that, we have the latest spectacular jobs report that simply blew everybody's minds! But is the economy really as good as the propagandists are spinning it to be, and what is the risk in embracing this newfound optimism?

- Source, Silver Doctors

Wednesday, November 6, 2019

The path to $3,000 gold and beyond depends on this...

“What I look at is the balance sheet of Federal Reserve ,” Oliver told Kitco News. “When [government] bonds finally break down, and they will break down someday because congress is insolvent, the only thing else on the Fed’s balance sheet is of course the gold, because they said they have 8,100 tonnes of gold.”

- Source, Kitco News

Would China and Russia Use the Nuclear Option on the United States?

Such a move would cause a severe spike in US interest rates, crash our stock market, and easily push the economy into recession. It’s an extreme scenario, and many analysts believe it would temporarily hurt their own economies, too.

But neither is the risk zero , given the unending tension in the trade and currency wars. As Mike Maloney and Ronnie Stoeferle discuss in their third video, while US Treasury holdings of both countries are in decline, they are both simultaneously loading up on gold. Russia has been a long-standing buyer on a monthly basis, and China has now added gold to its Reserves for 10 consecutive months.

As Ronnie says, “it’s no coincidence that China is updating its gold reserves monthly.” The gold-buying trend stretches beyond China, Russia and other emerging markets. Many countries in Europe have been aggressively adding gold to their Reserves—for example, Poland, Romania, and Hungary.

Further, many of these countries are repatriating their gold from London. In other words, the gold buying isn’t coming just from countries that are hostile to the US, but also its allies.

- Source, Gold Silver

Tuesday, November 5, 2019

The Not Enough Inflation Hoax: Is It Ignorance or Deception?

The dollars that you work hard for are always buying less and less, yet the government tells you there's 'not enough inflation'.

The Federal Reserve is a government-created monopoly that counterfeit dollars by the billions and trillions, and you're supposed to believe that this is "capitalism." Oh, the tangled web they weave...

- Source, Ron Paul

Saturday, November 2, 2019

Nick Barisheff: Gold Beating Buffett Since 2000, Will Continue to Do So

Every week, there are new warnings sounding about an ever increasing wobbly economy? Stocks are near record highs, and so is the global debt.

So, what do you do?

Nick Barisheff, CEO of Bullion Management Group (BMG), says, “In the U.S. dollar since 2000, gold is up an average of 9.4% per year. In some countries, it’s up 14% and so on.

If you take the overall average of all the countries, the average increase is 10% a year. Every time Warren Buffett is on CNBC, he seems to go out of his way to disparage gold, but if you look at a chart of Berkshire Hathaway and gold, gold has outperformed Berkshire Hathaway.

Everybody worships Warren Buffett as the best investor in the world, and gold has outperformed his fund in U.S. dollars . I would not disparage gold if I were him. I’d keep quiet about it.”

There is a first for Barisheff, too, in this financial environment. He says for the first time ever, he’s “100% invested in gold” as a percentage of his portfolio. He says the bottom “is in for gold,” and “the bottom is in for silver, too.”

Barisheff contends with the record bubbles and the record debt, both gold and silver will be setting new all-time high records, as well, in the not-so-distant future.

- Source, USA Watchdog

Friday, November 1, 2019

What if the Fed Stops Cutting Rates?

Fed rate cuts have been the driving force of the recent gains in precious metals.

This is not a surprise to our readers as since 2018 we argued that a shift in Fed policy from rate hikes to rate cuts would springboard the next big move. History argued the same.

The market is showing a roughly 90% chance the Fed will cut rates this week which indicates the market has essentially already priced in the rate cut.

The potential for a pause in the rate cuts could be why Gold, Silver and mining shares are all off their summer highs, despite an imminent rate cut.

This is why we expect the precious metals sector will continue to correct and especially in terms of time. It remains to be seen whether the correction continues as aprice correction or morphs into a bullish consolidation.

In either case, precious metals will need a new narrative if the Fed pause is sustained well into 2020. Enter rising inflation and rising inflation expectations.

With respect to the Fed, if they don’t raise rates as inflationrises then that causes a steepening yield curve as well as a decline in real interest rates. Those things are bullish for precious metals.

In the chartbelow we plot the inflation expectations ETF RINF followed by the TIP to TLT ratio, the CRB (commodity prices) and the Yield Curve.

Note how inflation expectations increased in 2016 and until the middle or end of 2018. It was also during this time that the yield curve flattened as the Fed raised rates.

The combination of rising inflation and rising inflation expectations was not bullish for precious metals in 2017 and 2018 because the Fed raised rates, the yield curve flattened and real interest rates declined.

At present we can see RINF and TIP vs. TLThave formed double bottoms while the CRB is on the cusp of breaking its downtrend and the Yield Curve has rebounded.

Simply put, if inflation and inflation expectations trend higher like in 2017 and 2018 but the Fed doesn’t raise rates, it is bullish for precious metals. In this scenario, Silver will outperform Gold and the juniors would outperform also.

Over the past week or so there have been a few positives with respect to the mining stocks. Both GDX and GDXJ formed mini-double bottoms while the silver stocks have performed even better.

We do need to keep an eye out for how the miners perform if the Fed indicates a pause is coming. Their performance over the weeks ahead could give us an early hint as to how much longer the correction will last.

In the meantime, we have been focusing on identifying and accumulating quality juniors with significant upside potential in 2020.

This is not a surprise to our readers as since 2018 we argued that a shift in Fed policy from rate hikes to rate cuts would springboard the next big move. History argued the same.

The market is showing a roughly 90% chance the Fed will cut rates this week which indicates the market has essentially already priced in the rate cut.

The potential for a pause in the rate cuts could be why Gold, Silver and mining shares are all off their summer highs, despite an imminent rate cut.

This is why we expect the precious metals sector will continue to correct and especially in terms of time. It remains to be seen whether the correction continues as a

In either case, precious metals will need a new narrative if the Fed pause is sustained well into 2020. Enter rising inflation and rising inflation expectations.

With respect to the Fed, if they don’t raise rates as inflation

In the chart

Note how inflation expectations increased in 2016 and until the middle or end of 2018. It was also during this time that the yield curve flattened as the Fed raised rates.

Inflation Expectations Indicators

The combination of rising inflation and rising inflation expectations was not bullish for precious metals in 2017 and 2018 because the Fed raised rates, the yield curve flattened and real interest rates declined.

At present we can see RINF and TIP vs. TLT

Simply put, if inflation and inflation expectations trend higher like in 2017 and 2018 but the Fed doesn’t raise rates, it is bullish for precious metals. In this scenario, Silver will outperform Gold and the juniors would outperform also.

Over the past week or so there have been a few positives with respect to the mining stocks. Both GDX and GDXJ formed mini-double bottoms while the silver stocks have performed even better.

We do need to keep an eye out for how the miners perform if the Fed indicates a pause is coming. Their performance over the weeks ahead could give us an early hint as to how much longer the correction will last.

In the meantime, we have been focusing on identifying and accumulating quality juniors with significant upside potential in 2020.

- Source, The Daily Gold

Thursday, October 31, 2019

Is Another Housing Crisis Like 2008 in the Near Future?

A decade after the last crisis, is another housing bubble brewing in North America? Los Angeles-based real estate investor Nick Halaris travels to two of the continent’s hottest markets – Vancouver and Seattle – to find out.

By speaking to many different types of people at the center of those markets, Nick develops a 360-degree view of both cities. This allows him to draw his conclusion –and to leave viewers with an even more important question.

- Source, Real Vision Finance

Wednesday, October 30, 2019

Tuesday, October 29, 2019

Alex Newman: Does the Government Think Own Your Children?

Alex Newman visits Finance and Liberty and Reluctant Preppers for the first time to warn us that our children and our liberty are in peril. "The education fight — between those who want to provide solid schooling in the three R’s and other subjects and those who want to change kids’ core beliefs — is culminating.

There is a silent struggle raging right now upon which the future of America and her liberties depends — literally. At its core, the struggle revolves around who will be responsible for children and their upbringing.

Ultimately, there are only two options: parents or government . Right now, government appears to be winning. It is gaining ground with each passing generation, and with each passing day, through the public education system.

But if luminaries of the Left get their way, this is only the beginning. The end goal goes far beyond education and touches every aspect of life."

- Source, Reluctant Preppers

Sunday, October 27, 2019

“Not QE” is in high gear, $7.5 billion in one day...

- Source, Golden Rule Radio

Friday, October 25, 2019

Addison Quale Explains How to Earn Interest on Gold

- Source, Jay Taylor Media

Thursday, October 24, 2019

QE4ever Arrives in One Quantifiable Quantum Leap

It’s QE4ever, Baby! The Fed’s latest move back into quantitative easing took a quantum leap in a single day with last week’s rush announcement of major permanent money injections to begin this Tuesday. Since the Fed adamantly denies it is doing what it is doing — going back to quantitative easing (because they legally have to deny it) — we could just call it the Fed’s new quantitative mechanics.

If we must avoid the term quantitative easing, as some writers are insisting we should, I’ve come up with the new term from the definition of quantum mechanics in which, objects have characteristics of both particles and waves and there are limits to the precision with which quantities can be measured (the uncertainty principle)…. Quantum mechanics gradually arose from theories to explain observations which could not be reconciled with classical physics.

Thus, quantitative mechanics, seems to fit the Fed’s latest move, though I think I’ll just stay with QE4ever since it follows QE3. The Fed certainly exhibits great uncertainty about about the principle size of its new quantitatively massive injections of money. You’ll see in all the quotes below how large each dose will be and how long these emergency operations that are not an emergency will continue. All of it put in terms that are hard to quantify because they are always preceded with “at least.”

The money that matters will be created out of nothing yet will, “at least,” match previous rounds of QE in size. Like things in quantum mechanics that can be in two placesin the same time or seem to be two different kinds of things at the same time, the new QE that isn’t QE is also not an emergency response, even though it had to be decided on, announced and started before the next Fed meeting arrives later this month. Though the Fed says it not easing, I will lay out below how it is easing in every respect. In short, it looks exactly like the old quantitative easing and functions exactly like the the old QE, so it Q-uacks like a duck and is a duck. The Fed says it is not because it has a different motivation, as if I care what their motivation is.

Thus, quantitative mechanics, seems to fit the Fed’s latest move, though I think I’ll just stay with QE4ever since it follows QE3. The Fed certainly exhibits great uncertainty about about the principle size of its new quantitatively massive injections of money. You’ll see in all the quotes below how large each dose will be and how long these emergency operations that are not an emergency will continue. All of it put in terms that are hard to quantify because they are always preceded with “at least.”

The money that matters will be created out of nothing yet will, “at least,” match previous rounds of QE in size. Like things in quantum mechanics that can be in two places

- Source, The Great Recession

Wednesday, October 23, 2019

Ted Butler: More Unanswered Questions

It was, after all, a simple question that sparked my interest in silver from the start. Some 35 years ago, my now-departed friend and mentor, Israel Friedman, challenged me with a question that took me a year to answer. Actually, “challenged” is not the right word, either back then or today. Izzy simply asked a question to which he had no real answer of someone he thought might be able to answer. In a real sense, the question conveyed a degree of respect, in that Izzy only asked me because he thought I might have an answer. It is with that same degree of respect that I ask for answers to my own questions today.

Back then (1985), Izzy asked me why I thought silver was priced so cheaply (around $5/oz ) in the face of universal awareness that the world was consuming more silver than was being produced (mining plus recycling); a deficit consumption pattern that had existed for more than 45 years to that point. Simply put, a deficit consumption pattern is the single most bullish condition possible for any commodity, yet silver appeared to be immune from the law of supply and demand.

Of course, silver had run up to $50 five years earlier, thanks largely to the Hunt Brothers, and Izzy had played that run better than just about anyone, buying at $4 and selling at $40. But that was then (1980) and this was now (1985) and silver was again as low as it had been when Izzy first bought it in the mid-1970’s. Since he had already mastered the silver market, I was a bit perplexed why Izzy was even asking me to answer his question, but I could see he was asking because he valued my opinion – it was less a challenge and much more a seeking of the right answer. In that circumstance, I was not about to offer some off the top of my head flippant answer and I told Izzy I would think about it.

As it turned out, I thought about the answer for more than a year, because Izzy’s question was so darned good – why silver was so cheap in the face of the most bullish supply and demand circumstances possible for any commodity. The answer, of course, was that silver was artificially depressed in price due to excessive and concentrated short selling in COMEX futures – the same answer that explains silver’s depressed price to this day. Quite ironically, Izzy did not accept my answer for a number of years (because I don’t think he was expecting it), but eventually came to embrace it fully, coming to coin terms like “slicing the salami” (the practice by which the commercials get the technical funds to buy or sell) and “full pants down” (an overrun of the big commercial shorts).

Since I believe that much general good came from Izzy asking me his question so many years ago, I would like to use that same approach now to solicit an answer to a question that has bothered me for the past eight and a half years. I do think I know much of the answer (which I’ll provide), but I would like to hear what others have to say since it’s something rarely discussed. I’ll state the facts which can be easily verified and ask you to come up with an answer to the question of why so much silver is being physically moved in and out from the COMEX silver warehouses?

Back then (1985), Izzy asked me why I thought silver was priced so cheaply (around $5/

Of course, silver had run up to $50 five years earlier, thanks largely to the Hunt Brothers, and Izzy had played that run better than just about anyone, buying at $4 and selling at $40. But that was then (1980) and this was now (1985) and silver was again as low as it had been when Izzy first bought it in the mid-1970’s. Since he had already mastered the silver market, I was a bit perplexed why Izzy was even asking me to answer his question, but I could see he was asking because he valued my opinion – it was less a challenge and much more a seeking of the right answer. In that circumstance, I was not about to offer some off the top of my head flippant answer and I told Izzy I would think about it.

As it turned out, I thought about the answer for more than a year, because Izzy’s question was so darned good – why silver was so cheap in the face of the most bullish supply and demand circumstances possible for any commodity. The answer, of course, was that silver was artificially depressed in price due to excessive and concentrated short selling in COMEX futures – the same answer that explains silver’s depressed price to this day. Quite ironically, Izzy did not accept my answer for a number of years (because I don’t think he was expecting it), but eventually came to embrace it fully, coming to coin terms like “slicing the salami” (the practice by which the commercials get the technical funds to buy or sell) and “full pants down” (an overrun of the big commercial shorts).

Since I believe that much general good came from Izzy asking me his question so many years ago, I would like to use that same approach now to solicit an answer to a question that has bothered me for the past eight and a half years. I do think I know much of the answer (which I’ll provide), but I would like to hear what others have to say since it’s something rarely discussed. I’ll state the facts which can be easily verified and ask you to come up with an answer to the question of why so much silver is being physically moved in and out from the COMEX silver warehouses?

- Source, Ted Butler, read the full article here

Tuesday, October 22, 2019

Political Purgatory vs Economic Reason

What are the solutions? What can we do? Stay tuned until the end for Mike's trademark answer to these most important questions.

- Source, Gold Silver

Monday, October 21, 2019

The ALMOST Everything Bubble Will Implode

During this one hour interview Mike recalls his early battles with dyslexia and how it became a gift in disguise.

Along with his thoughts on the current state of the markets, Mike details his first steps as an entrepreneur... leading all the way up to the foundation of Gold Silver.

- Source, Gold Silver

Sunday, October 20, 2019

The developed world is on the brink of a financial, economic, social and political crisis

- Source, Livewire Markets

Saturday, October 19, 2019

Warren Buffet’s Financial Crisis Warning...

Panicked investors rushed for the door, banks refused to lend to each other, and money market funds began to collapse. “I describe it as an economic Pearl Harbor,” Warren Buffett, the legendary investor of Berkshire Hathaway, told VICE News. “It was something we hadn’t seen before. Even the 1929 panic was nothing like this.

I mean, the system stopped.“ Buffett had a front row seat to the global crisis even before the Bush Administration took up the struggle. He had been approached by Lehman’s CEO Dick Fuld for emergency capital earlier in the summer, and after it failed, he found himself courted by other teetering investment banks desperate for capital.

His $5 billion investment in Goldman Sachs saved the firm, and netted him billions. He credits the Bush administration, led by Treasury Secretary Hank Paulson, with helping to prevent a second Great Depression. “When they realized the gravity of what was happening, we were having a run on the United States, maybe a run on the world, they stepped up,” Buffett said.

He’s not convinced, however, that the financial community's takeaway from its brush with financial Armageddon will prevent future disaster.

“Humans will continue to behave foolishly and sometimes en masse. And that doesn’t change. We get smarter but we don’t get wiser," Buffett said.

- Source, Vice News

Friday, October 18, 2019

The Collapse of the American Empire?

He's been a vociferous public critic of presidents on both sides of the American political spectrum, and his latest book, 'America, the Farewell Tour,' is nothing short of a full-throated throttling of the political, social, and cultural state of his country.

- Source, The Agenda

Thursday, October 17, 2019

What’s stopping gold from climbing substantially higher?

- Source, Kitco News

Wednesday, October 16, 2019

Negative Rates Won't Rescue The Fed, Nor Will Pretending That Everything's Fine

Central planners always box themselves into a corner. Neither lies, nor more counterfeiting can fix the troubles they've created.

- Source, Ron Paul

Mait Taibbi: We're in a Permanent Coup

I’ve lived through a few

The kickoff begins when a key official decides to buck the executive. From that moment, government becomes a high-speed head-counting exercise. Who’s got the power plant, the airport, the police in the capital? How many department chiefs are answering their phones? Who’s writing tonight’s newscast?

When the KGB in 1991 tried to

A key moment came when one of Yeltsin’s men, Alexander Rutskoi – who two years later would himself lead a coup against Yeltsin – prevailed upon a Major in a tank unit to defy KGB orders and turn on the “criminals.”

We have long been spared this madness in America. Our head-counting ceremony was Election Day. We did it once every four years.

That’s all over, in the Trump era.

On Thursday, news broke that two businessmen said to have “peddled supposedly explosive information about corruption involving Hillary Clinton and Joe Biden” were arrested at Dulles airport on “campaign finance violations.” The two figures are alleged to be bagmen bearing “dirt” on Democrats, solicited by Trump and his personal lawyer, Rudy Giuliani.

Lev Parnas and IgorFruman will be asked to give depositions to impeachment investigators. They’re reportedly going to refuse. Their lawyer John Dowd also says they will “refuse to appear before House Committees investigating President Donald Trump.” Fruman and Parnas meanwhile claim they had real derogatory information about Biden and other politicians, but “the U.S. government had shown little interest in receiving it through official channels.”

For Americans not familiar with the language of the Third World, that’s two contrasting denials of political legitimacy.

The men who are the proxies for Donald Trump and Rudy Giuliani in this story are asserting that “official channels” have been corrupted. The forces backing impeachment, meanwhile, are telling us those same defendants are obstructing a lawful impeachment inquiry.

This latest incident, set against the impeachment mania and the reportedly “expanding” Russiagate investigation of U.S. Attorney John Durham, accelerates our timeline to chaos. We are speeding toward a situation when someone in one of these camps refuses to obey a major decree,arrest order , or court decision, at which point Americans will get to experience the joys of their political futures being decided by phone calls to generals and police chiefs.

My discomfort in the last few years, first with Russiagate and now with Ukrainegate and impeachment, stems from the belief that the people pushing hardest for Trump’s early removal are more dangerous than Trump. Many Americans don’t see this because they’re not used to waking up in a country where you’re not sure who the president will be by nightfall. They don’t understand that this predicament is worse than having a bad president...

We have long been spared this madness in America. Our head-counting ceremony was Election Day. We did it once every four years.

That’s all over, in the Trump era.

On Thursday, news broke that two businessmen said to have “peddled supposedly explosive information about corruption involving Hillary Clinton and Joe Biden” were arrested at Dulles airport on “campaign finance violations.” The two figures are alleged to be bagmen bearing “dirt” on Democrats, solicited by Trump and his personal lawyer, Rudy Giuliani.

Lev Parnas and Igor

For Americans not familiar with the language of the Third World, that’s two contrasting denials of political legitimacy.

The men who are the proxies for Donald Trump and Rudy Giuliani in this story are asserting that “official channels” have been corrupted. The forces backing impeachment, meanwhile, are telling us those same defendants are obstructing a lawful impeachment inquiry.

This latest incident, set against the impeachment mania and the reportedly “expanding” Russiagate investigation of U.S. Attorney John Durham, accelerates our timeline to chaos. We are speeding toward a situation when someone in one of these camps refuses to obey a major decree,

My discomfort in the last few years, first with Russiagate and now with Ukrainegate and impeachment, stems from the belief that the people pushing hardest for Trump’s early removal are more dangerous than Trump. Many Americans don’t see this because they’re not used to waking up in a country where you’re not sure who the president will be by nightfall. They don’t understand that this predicament is worse than having a bad president...

- Source, Matt Taibbi, read the full article here

Tuesday, October 15, 2019

Is Gold Preparing For A Correction? Silver Price Detaches

Thursday, October 10, 2019

Silver Fortune: Baby Boomers are Screwed in the Next Recession

- Source, Silver Fortune

Wednesday, October 9, 2019

Ron Paul: Federal Reserve’s Latest Bailouts More Proof Bad Times Ahead

- Source, Ron Paul

Saturday, October 5, 2019

Friday, October 4, 2019

Financial Crisis, Broken Promises, and Complacency

- Source, Silver Fortune

Thursday, October 3, 2019

Sunday, September 29, 2019

Craig Hemke: Gold and Silver Manipulation Criminal Racketeering Charges To Reach The Top?

- Source, The Silver Doctors

Friday, September 27, 2019

Gold & Silver Sense America's The Last Thing On Politicians Minds?

Washington fiddles while America burns? Join Mike & Half Dollar as they break-down the latest news, and participate in the conversation through the live-chat or by calling-in to the show.

- Source, The Silver Doctors

Thursday, September 26, 2019

Ben Hunt: Prepare To Get Burned

And science informs us that even the most simple systems become nearly impossible to predict or control with 100% precision as time and variables change.

But our society today is ignoring these lessons. It’s betting that the increasingly excessive distortions required to keep the status quo continuing will succeed, and come at no cost.

- Source, Peak Prosperity

Wednesday, September 25, 2019

Gold hits 2 week high on growth fears, palladium scales new peak

Spot gold was up 0.5% at $1,524.71 per ounce, after hitting its highest since Sept. 6. U.S.

“The weak German PMI numbers gave a little bit of a shock to the stock market and led investors into safety like gold and silver,” said Phillip Streible, senior commodities strategist at RJO Futures.

Gold could hit $1,550 in this supportive environment of “weak interest rates, increasing geopolitical risks, no (trade) agreement with China and weak data that shows we are slipping into recession,” Streible added.

German private sector activity shrank for the first time in 6-1/2 years in September as a manufacturing recession deepened unexpectedly and growth in the service sector lost momentum, while euro zone business growth stalled, a survey showed on Monday.

Meanwhile, better-than-expected U.S.

Investors are also keeping a close eye on

Adding to geopolitical tensions, U.S. President Donald Trump on Friday approved sending American troops to bolster Saudi Arabia’s air and missile defenses after the largest-ever attack on the kingdom’s oil facilities.

Meanwhile, palladium prices soared to a record high of $1,664.50 an ounce. The

“People are starting to realize that auto sales and production outside of China is actually not so bad and so demand from the industrial sector is stronger that what people thought,” said Jeffrey Christian, managing partner of CPM Group.

“In addition to that, there are a lot of investors moving

Elsewhere, silver gained 3.5% to $18.61 per ounce and platinum rose 1.8% to $962.55.

- Source, CNBC

Tuesday, September 24, 2019

Christine Lagarde: The Trade War Is Weighing on the Global Economy

Lagarde, who has run the International Monetary Fund since 2011 and was selected in July to replace Mario Draghi on Nov. 1, said the tariffs that the U.S.

“That’s a massive number,” Lagarde said in an interview with CNBC’s Sara Eisen. “It’s fewer jobs. It’s less business going on. It’s less investment. It’s more uncertainty. It weighs like a big, dark cloud on the global economy.”

“I think

Top trade negotiators from the U.S.

“The longer this lingers, the more uncertainty sinks in. And if you’re an investor, if you’re an enterprise, whether small, medium size or big, you’re not going to invest, you’re going to wait. You’re going to sit and wonder where the supply chains are going to be organized,” Lagarde said in the interview that aired Monday on CNBC’s “Squawk on the Street.”

- Source, CNBC

Subscribe to:

Posts (Atom)