TRACKING THE GOLD AND SILVER INVESTMENT COMMUNITY, WORLDWIDE - AN UNOFFICIAL EDITING OF RELATED INVESTMENT COMMENTARY

Saturday, May 30, 2020

Ultimate Confusion: What’s really Holding Gold and Silver Prices Back?

Friday, May 29, 2020

Inflation, Deflation, or Stagflation and the Implications for Gold

Wednesday, May 27, 2020

Mike Maloney: Will You Be Able To Get Cash From Banks In A Crisis?

Monday, May 25, 2020

Massive Demand: United States Mint Gold Coin Sales Already Double What it Was in 2019

Interestingly, sales for precious metals bullion retail products, according to Dan at Cloud Hard Assets, are running about 60% for gold and 40% for silver (total value, not ounces). Investors would be buying more silver, but due to the backlog and shortage of retail silver bullion products, individuals are being forced to buy more gold.

According to the U.S. Mint’s most recent update, sales of 2020 Gold Eagles totaled 332,000 oz compared to only 152,000 oz for 2019. Furthermore, Gold Buffalo coin sales have reached 117,500 oz versus only 61,500 for 2019. Again, we are only five months into 2020, so it will be interesting to see what demand for these U.S. Gold coins will be for the remainder of the year.

Investors looking to acquire Gold Eagles and Buffalos are still paying high premiums. In comparing the premiums for 2020 Gold Eagles and Buffalos, the best value that I could find from the leading online dealers is about 8%. However, the Gold Buffalo coin premiums were even higher.

Here is an update on the BEST BUY PRICES for 2020 Gold Eagles and Buffalos from the leading online dealers’ vs. CLOUD HARD ASSETS (Prices below based on $1,745+ gold spot price early Thursday):

As you can see, it’s important to compare the prices of gold bullion products (and services). Moreover, I am putting together a spreadsheet comparing the top online dealers’ Silver Eagle premiums vs. CLOUD HARD ASSETS. Today, the top online dealers 2020 Silver Eagle premiums are running about 59% of the current spot price vs. 39% for CLOUD HARD ASSETS. Again, it’s wise to compare prices and services at the different precious metals dealers.

Again, the prices above were based on a $1,745+ gold spot price during early Thursday trading.

Sunday, May 24, 2020

Alasdair Macleod: Will COVID-19 Lead to a New Gold Standard?

Friday, May 22, 2020

Can You Prosper During this Gargantuan Economic Decline?

Thursday, May 21, 2020

Dave Kranzler: Gold Bullion Banks Have Been Lucky For A Specific Reason

Tuesday, May 19, 2020

David Skarica: The Bear Market Rally is Over

Saturday, May 16, 2020

Ron Paul: Did Lying About Coronavirus Cover Up The Fed’s Economic Destruction?

Friday, May 15, 2020

Midas Touch: $9000 Gold and Triple Digit Silver Prices Will Come, But Do This First

Thursday, May 14, 2020

Gold Sets Its Sights on $1800, Much Higher Prices Coming Soon

In an interview with CNBC, Teves explained that investor interest in gold has skyrocketed, not only because of all-encompassing uncertainty but also due to central bank actions that have already caused some concern. As Teves noted, the slicing of interest rates has harmed bonds that were posting all-time low showings prior to the outbreak.

David Lennox, a resources analyst at Fat Prophets, echoed much of what Teves said, telling CNBC that interest rate cuts and money printing will greatly diminish the willingness to hold fiat currencies. Lennox also pointed to the growing sovereign debt issue that is, and will likely continue to be, aggravated by governments attempting to stimulate their economies post-coronavirus by any means necessary.

The spike in interest in gold investment was shown in a recent report by the World Gold Council, which revealed that individual investors and funds pushed central banks aside to become the biggest buyers of gold in Q1 as panic gripped the global markets. Among other things, the report noted that funds bought the most gold out of any quarter over the last four years in that period.

All investors should treat gold as a core asset

In a recent webinar hosted by British financial communications firm Buchanan, some of the most prominent figures in global finance shared their bullish sentiment regarding gold and urge people not to overlook the metal.

Michael Widmer, head of metals research at Bank of America, James Burdass, gold specialist and independent consultant, Gervais Williams, fund manager at Premier Miton and Tom Attenborough, head of international business development and primary markets at the London Stock Exchange all shared their views on why gold should be treated as a key part of every person’s portfolio, rather than being approached as an afterthought.

Widmer expanded upon his highly bullish sentiment that recently saw him and his team of analysts call for gold to reach $3,000 within the next 18 months. According to Widmer, he had been bullish on gold prior to the pandemic, and its blow to the global economy lowered bond yields even further, along with bringing about massive amounts of money printing.

During the panel, Williams called for gold to reach $3,300 by the end of the year as negative interest rates become the norm. Williams also pointed out that gold is benefitting from being resilient to whatever scenario the economic recovery involves. Burdass highlighted the impact that the ballooning of global debt will have on various economies.

According to Burdass, the toll that the coronavirus has had on the global economy will be felt for years to come. Although Burdass voiced a more modest gold forecast of $1,850 by year’s end, he noted that the coronavirus’ after-effects will bring gold’s role as a store of value to the forefront and cause people to significantly reassess their allocation to the metal. Attenborough added that gold’s spike to the highest level in over seven years should be seen as a call to action for people to add the metal to their portfolio.

Gold is a tailor-made investment for environments such as these

Out of the various good reasons to own gold in the current climate, MarketWatch’s Jared Dillian thinks money printing should perhaps be seen as the most poignant one. Ever since the U.S. dollar was untethered from gold in 1971, gold bugs, along with numerous experts and analysts, have criticized the ability by central banks to print as much money as they want, whenever they want it.

And while money printing has been a persistent concern at any point over the past few decades, the trillions of dollars that were printed as a response to the biggest economic downturn since the Great Depression have made Dillian especially wary. While gold fulfills many roles, preservation of purchasing power is certainly among the most important ones. And while this role is normally treated as a benefit to be reaped over years or decades, the recent Quantitative Easing (QE) programs have made it more of an immediate perk.

While gold purchases tend to be fear-driven, gold’s climb to $1,700 and above over a short span of time is indicative of a fear of a rapid loss of purchasing power. Dillian believes it is this fear that shot gold’s price up from $800 in 2009 to $1,900 in 2011 as the Federal Reserve began its QE. Notably, gold stuck far above its starting point even as the fear subsided and the economy stabilized.

Whether fears of inflation are justified or not, the Fed’s openness to print an infinite amount of money, as opposed to a capped figure in 2008, is reason enough to be very optimistic on gold’s prospects. The federal deficit was another major price driver between 2009 and 2011, so it’s exceedingly relevant that the government is now bracing for the biggest deficit in the nation’s history.

Even in the absence of factors such as these, Dillian firmly advocates some allocation to gold within one’s savings, as it can help to reduce volatility. When taking into consideration the current climate, there is no shortage of volatility to be slashed.

Wednesday, May 13, 2020

Gold investment demand has room to grow after record first quarter

Monday, May 11, 2020

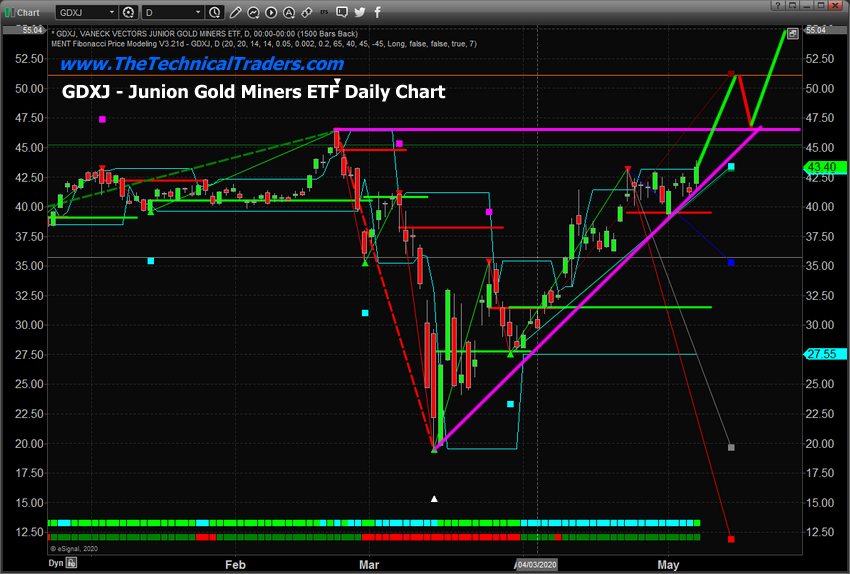

Junior Gold Miners Ready To Run Higher

Gold, the bell-weather safe-haven asset, initially collapsed when the US stock market started the massive selloff in late February 2020, then recovered to higher price levels near $1785 recently. Since reaching these levels, Gold has stalled into a sideways price flag near major resistance.

Silver, on the other hand, is trading near $15.60 and has yet to really recover to anywhere near the levels it had achieved in early January 2020 (near $18.60).

Well, GDXJ, the Junior Gold Miners ETF, is suggesting a very strong price rally is taking place that may push both Gold and Silver substantially higher. Key resistance exists near $46.50. Once broken we believe a very strong price rally will take place pushing GDXJ price levels to $51 or $52. After that, a brief downside rotation will potentially retest the $47 to $48 levels before an even bigger upside rally takes place. What is even more important is that we believe this big breakout move could start as early as next week, May 12th or after.

GDXJ Daily Chart

This GDXJ Weekly chart highlights the same price pattern and shows why we believe the upside price breakout could be a massive new trend. The Deep price low setup because of the COVID-19 virus event creates a very big price range for any future price advancements. That $24 price range, if applied to price levels before the breakdown event near $41, may suggest GDXJ could rally to levels above $65 over the next few weeks or months.

GDXJ Weekly Chart

Concluding Thoughts:

We believe the upside rally in both Gold and Silver recently is a very good indication that the sideways price channel that has plagued precious metals recently may be ending. If precious metals prices begin to rally, then GDXJ will break the upper $46.50 resistance level and begin a new upside price rally clearing the resistance setup before the virus event began.

Get ready, this could be a very big move higher for Junior Miners and it could align with our May 8th through May 12th global market inflection point prediction.

Saturday, May 9, 2020

Gold Needs to be a Core Asset for All Investors

Speaking in a webinar Thursday, Michael Widmer head of metals research at Bank of America, James Burdass, gold specialist and independent consultant, Gervais Williams, fund manager at Premier Miton and Tom Attenborough, head of international business development and primary markets at the London Stock Exchange, all voiced their bullish sentiment for gold and mining stocks. The webinar was organized by British financial communications firm Buchanan.

Bank of America recently grabbed headlines in financial news after Widmer’s team of analysts said that they see gold prices pushing to $3,000 an ounce within 18 month.

Widmer said that the bank has been bullish on gold for a while and because of the COVID-19 pandemic, the market has been “supercharged” as central banks and governments have pumped financial markets full of liquidity. He added that in a low growth environment real yields will remain low and that is an important driver for gold prices.

“From as asset allocation perspective, it makes sense to hold a bit of gold in your portfolio,” he said during presentation.

However, there is someone who is even more bullish than Bank of America. Williams said that he sees gold prices pushing to $3,300 an ounce by the end of the year as interest rates go negative.

Williams added that over the coming months, generalist investors will be paying more attention to the mining sector as these are the companies that will be generating cash flow and dividends.

“Investors are going to need assets that are growth companies and provide dividends. The gold sector is a great area to invest in from this point of view,” he said. “We are not certain as to what the recovery is going to look like. The background is pretty uncertain but gold is resilient to these risks.”

Burdass said that he likes gold and miners as the global economy is going to be stuck with massive amounts of debt. He added that the impact the COVID-19 pandemic is having on the global economy will be felt for years to come.

“COVID-19 is going to be a game-changer for asset allocation in the gold market,” he said. “Gold as a store of value is unbeatable.”

Burdass said that he sees gold prices at $1,850 by the end of the year.

Attenborough said that gold’s rally in the last month with prices pushing to a 7.5 year high was an indication that gold should be a core asset in all portfolios.

“Generalist should see [the current environment] as an opportunity to include some gold in their portfolio,” he said.

Friday, May 8, 2020

Assets on Fed balance sheet rise to record $6.72 trillion

The numbers: The Federal Reserve’s balance sheet expended to a record $6.72 trillion in the week ended May 6, up from $6.66 trillion in the prior week, the central bank said Thursday.

What happened: Growth in the balance sheet has been slowing at the Fed has tapered the pace of its asset purchases. Its assets grew by $65 billion in the past week, down from growth of $82.8 billion in the prior week. In addition, some of the Fed’s new loan programs are not yet operational.

The central bank’s holding of Treasury bills and notes rose by $48.8 billion in the past week to $4.02 trillion while its holdings of mortgage-backed bonds rose $660 million.

Banks outside the U.S continued to show demand for dollars. Liquidity swaps lending greenbacks to other central banks rose by $5.9 billion to $444.9 billion.

A program to allow banks to get credit using their Paycheck Protection Program loans as collateral rose by $9.7 billion to $29.2 billion.

Other Fed programs, including the Primary Dealer Credit Facility and the Money Market Mutual Fund Liquidity Facility, saw a decline in use over the past week.

Big picture: “We now look for the Fed to extend large-scale quantitative easing through year-end, purchasing an additional $1.3 trillion in Treasury and mortgage-backed securities in the second half. This would bring the total estimated asset purchases to $3.5 trillion. Of this, the Fed purchases of Treasuries are likely be $2.7 trillion, which represents a significant 67% of the $4 trillion in net new marketable Treasury debt issued to fund the ballooning deficit for this calendar year. As such, the Fed balance sheet is now poised to rise to $10.5 trillion by year-end,” said Kathy Bostjancic, director, U.S. macro investor services, at Oxford Economics.

- Source, Market Watch

Thursday, May 7, 2020

Silver Is Due For An EPIC Mean Reversion Relative To Gold

A couple weeks ago, I wrote a popular essay “Big Silver Bull Running!”. It explained what happened to silver in this recent COVID-19 stock panic, and why silver soared in its wake. Sucked into that blinding fear maelstrom, silver was thrashed to a miserable 10.9-year low. This metal plummeted in a near-crash, fueled by speculators’ fastest long purge ever witnessed! That exhausted their selling, totally resetting longs.

That meant these super-leveraged traders’ capital firepower was fully available to buy back into silver. And much more bullish than that, strong and relentless silver investment demand emerged since that mid-March collapse. That’s evident in the soaring silver-bullion holdings of silver’s leading exchange-traded fund, the SLV iShares Silver Trust! This dominant silver ETF is the best daily proxy for global investment demand.

The remarkable capital inflows pouring into silver through that major SLV conduit from American stock investors were explored in depth in that recent essay. But with surging investment demand as evident in SLV’s holdings its primary thesis, I only had room to tangentially touch on another very-important bullish silver factor. That’s silver’s relationship to its overwhelmingly-dominant primary driver, gold price trends.

This white metal has always tended to mirror and amplify whatever is happening in the yellow one. Silver effectively acts like a gold-sentiment gauge. Traders’ enthusiasm for silver mounts when gold is rallying on balance, leading them to bid silver higher well-outperforming gold. Since the world silver market is tiny compared to gold’s, worth just a small fraction in any given span, capital inflows fuel outsized silver gains.

But when gold is generally drifting lower, or grinding sideways long enough to shift sentiment to bearish, silver is abandoned. Speculators and investors alike are only interested in silver when they expect gold to continue materially advancing. With silver joined at the hip with gold psychologically, it tends to leverage significant gold moves by 2x to 3x. And where silver trades relative to gold is analogous to its valuation.

The best time to buy silver is when it is abnormally-inexpensive compared to prevailing gold levels. That can be measured through a simple construct called the Silver/Gold Ratio. But dividing silver prices by gold prices yields tiny hard-to-parse decimals like 0.0089 this week. So I’d rather use an inverted-axis Gold/Silver Ratio instead, which yields the same data in a much-easier-to-understand format like 112.1x.

The recent stock panic’s extraordinarily-extreme impact on silver is really illuminated by this SGR proxy. This chart shows how silver has fared relative to gold over the last decade-and-a-half or so. When this SGR line is rising, silver is outperforming gold. The opposite is true when the SGR falls, gold surpasses silver. This chart is jaw-dropping, revealing exceedingly-anomalous SGR levels which are wildly bullish for silver!

When silver plummeted to that extreme 10.9-year secular low of $11.96 on March 18th during the stock panic, the SGR soared to 124.1x! In other words, it took 124.1 ounces of silver to equal the dollar value of a single ounce of gold. That radical collapse literally forced the SGR off the charts! For over a century, about 100x was the ultra-rare SGR edge-case limit. Now all the long-term SGR charts have to be redrawn.

Our daily silver and gold data extends back to June 1969, an immensely-long 50.9-year secular stretch. Before March 2020’s stock panic, the worst SGR witnessed in that past half-century was 100.3x way back in February 1991. That only lasted two trading days before silver mean reverted back higher relative to gold. Our monthly silver and gold data runs much farther back to 1915. The SGR hit 97.3x in 1940 and 1941.

So in the 105 years leading into March 2020, the SGR had briefly challenged 100x precisely twice. And I’ve seen multi-century silver and gold charts cobbled together despite data becoming increasingly sparse the farther back in time peered. They imply this crazy 124.1x seen in mid-March was an apocalyptic all-time-record low in silver relative to gold! We just witnessed something so extreme it has never happened before.

Speculators’ most-extreme silver-futures long dump ever fueled silver’s near-crash, which obliterated this white metal to its most-extreme lowest levels ever compared to prevailing gold prices. Silver had never been cheaper relative to gold! This wildly-unprecedented anomaly is incredibly bullish for silver. All past low-silver-price SGR extremes have been followed by massive mean reversions higher in subsequent years.

The last modern example came after the previous stock panic in October 2008. These ultra-rare selling events spawn such overwhelming fear that they suck in everything else including gold and silver. In the same single-month span where the flagship US S&P 500 stock index plummeted 30.0%, silver collapsed 32.6%! That catapulted the SGR to 84.1x that month, which was a 13.6-year SGR high or silver-to-gold low.

Financial markets abhor extremes in long-term relationships. They not only never last long, but prices almost immediately start mean reverting back towards normal ratios after they are dragged way out of whack by anomalous shocks. And there is nothing more extreme than ultra-rare stock panics. The epic fear necessary to fuel them is so far beyond normal that there have only been 3 in the last 113 years!

The incredible carnage the frantic stock-panic mass selling inflicts on silver only lasts as long as peak fear in stock panics. And that is really fleeting since extreme fear quickly burns itself out. Once that initial overwhelming wave of fear passes, silver immediately begins mean reverting back higher absolutely and relative to gold. Silver bull markets grow enormous after stock panics, mean reverting before overshooting.

The Silver/Gold Ratio, and indeed many long-term price relationships, are like pendulums. Equilibrium is the long-term average, analogous to a pendulum hanging straight down at rest. The farther a pendulum is pulled to either side, the extremes, the faster and more forcefully it swings back down into its arc’s bottom mean. But its kinetic energy, like momentum in the markets, propels the pendulum to the opposing extreme.

In the years leading into late 2008’s stock panic, the SGR averaged 54.9x. That was right near the long-term secular mean as well, which ran 54.5x between 1970 to 2007. So for many decades both gold and silver miners used an SGR of 55x to convert byproduct production of their secondary metal into equivalent ounces of their primary one. When a relationship exists for decades, there’s good fundamental reason.

But like that pendulum, silver prices relative to gold’s didn’t just stop near 54.9x after silver’s super-low extremes during 2008’s stock panic. Instead they kept powering higher long after the mean, overshooting proportionally to the opposing one! If you pull a pendulum to the left, it’s going to swing back to roughly the same height on the right before running out of steam. Silver’s last post-panic bull market was huge.

In absolute terms silver more than quintupled out of its stock-panic lows, skyrocketing 442.9% higher over the next 2.4 years into April 2011! Silver far outperformed gold in that post-panic mean reversion and overshoot, with the panic-bottom 84.1x SGR blasting through that longstanding 54.9x mean to soar way up to 31.7x when that post-panic silver bull ultimately crested! Silver’s potential after stock panics is epic.

Investors flood back into silver for years after these ultra-rare extreme-selling events deeply scar them psychologically. A stock panic is technically a 20%+ S&P 500 plummeting in 2 weeks or less. Falling that fast spawns such mind-boggling fear that the total decline is often around a third in about a month! When stock investors suddenly and catastrophically lose that much of their wealth, they are forever changed.

They remember the wisdom of prudently diversifying their stock-heavy portfolios instead of foolishly being all-in stocks. So they gradually increase their virtually-nonexistent pre-panic allocations in gold and silver over the subsequent years. The precious metals are fantastic diversifying assets because they tend to rally on balance when stock markets are weakening or expected to. Silver can be more attractive than gold.

After stock panics, battered investors desperately want to be made whole again. After a 33% loss, getting back to break-even requires a 50% gain! And silver’s upside potential is much greater than gold’s simply due to the relative sizes of their markets. Think of these like market capitalizations of individual stocks. The smaller any market, the faster prices can be bid higher on any given capital inflows from investors.

The latest-available data for both world gold and silver demand is full-year 2019’s. According to the latest report from the World Gold Council, global gold demand last year ran 4,355.7 metric tons. That was worth $195.2b at 2019’s $1394 average gold prices. The Silver Institute’s latest data pegs world silver demand at 991.8m ounces in 2019. That was worth just $16.0b at last year’s average silver prices running $16.18.

So the global silver market is only about 1/12th as large as the world gold market! That means any given amount of capital flowing into silver can exert about 12x the upward-price impact of that same amount moving into gold. That’s the major reason why silver prices tend to amplify material gold-price trends by 2x to 3x. Devastated stock investors following panics also like the relative perceived cheapness of silver.

With an ounce of silver or SLV share costing far less than on ounce of gold or GLD share, investors looking to diversify in precious metals think they are getting more bang for their buck in silver. They like to own more ounces or shares rather than less, which makes them feel like their wealth has better potential to grow again. And once silver runs, investors love chasing winners so buying begets more buying.

All these post-stock-panic dynamics that helped silver quintuple after that last stock panic in late 2008 still exist today. And with that far-more-extreme all-time-record-high SGR in mid-March, today’s new post-panic silver bull has way more room to mean revert and overshoot to even-greater gains! If investors continue migrating back into silver in coming years like after the last stock panic, silver’s upside potential is epic.

Today’s secular gold and silver bulls began marching out of deep many-year lows in December 2015. From then until February 2020 prior to March’s extreme stock panic, the SGR averaged 79.0x. That is really high historically, as silver was languishing low and out of favor for much of recent years. But there’s no doubt the panic-stricken SGR has to at least shoot back up to that quasi-normal level in coming months.

With today’s prevailing gold prices near $1717, a mere mean reversion implies silver powering back up to $21.74. That’s another 41.9% above current levels, which would make for a good upleg. Silver’s maiden upleg in this bull peaked at 50.2% gains, while its most-recent upleg this past summer ran out of steam at +40.0%. But once silver regains that much ground relative to gold, its momentum should carry it much farther.

A proportional overshoot, the SGR pendulum swinging back towards the opposite extreme, portends far-greater post-stock-panic silver-bull gains. Silver would blast so much higher in that scenario that it would drag the SGR back down to 33.9x. That wouldn’t last long, it would mark the unsustainably-euphoric parabolic peaking of this silver bull. The last post-stock-panic bull shot the SGR even lower to 31.7x before failing.

At that same $1717 gold and this proportional-overshoot 33.9x, that implies silver soaring all the way up to $50.65 before this new post-stock-panic bull gives up its ghost! That’s certainly not unreasonable either, as silver peaked at $48.43 in April 2011 when that last post-stock-panic bull went terminal. That would make for a quadrupling out of March 2020’s extreme silver lows, a 323.5% bull run in coming years!

But running SGR mean-reversion-overshoot scenarios off today’s gold prices is way too conservative as it ignores gold’s own bull market. As I explored in an essay a few weeks ago, gold investment is soaring as well in this stock panic’s wake. This is also likely to persist for years, driving gold much higher. Gold will prove way more attractive than normal for years to come given the near-hyper-inflation gushing from the Fed.

In literally just 6 weeks from mid-March to late April, the Fed’s balance sheet exploded an eye-popping 52.4% or $2,261.2b higher! This central bank is printing money like there’s no tomorrow to monetize the colossal amounts of Treasuries the US government is issuing. It is trying to fight the terrible depression being forced upon us by governments’ own absurd draconian overreactions to the COVID-19 pandemic.

Those trillions of new dollars being paid directly to Americans through loans and grants are going to be competing for vastly-slower-growing goods and services on which to spend them. That is going to really bid up general price levels, unleashing stagflation fears among investors! This near-hyper-inflation will make gold and silver far more attractive and essential for portfolio diversification than after the last stock panic.

Only time will tell how high gold ultimately flies in this radically-unprecedented broken world, but after that last stock panic in October 2008 gold powered 166.5% higher over the next 2.8 years. So a doubling out of mid-March’s panic low of $1472 seems reasonable if not conservative. $3000 gold is certainly achievable in coming years! But let’s assume gold somehow only climbs 50% in this post-panic bull, hitting $2200.

At $2200 gold, a 79.0x silver-bull-mean SGR yields silver levels of $27.84. That’s 81.7% higher than this week’s silver levels in a mere mean reversion. If the inevitable overshoot fails early and just carries silver back up to its decades-old 55x SGR average, we’d be looking at a $40.00 silver target. And at that full proportional mean reversion of 33.9x, $2200 gold would imply silver soaring to new record highs near $64.90!

While these post-stock-panic silver-bull price targets are interesting, they really aren’t very important. Even if you only think silver has the potential to double or triple out of its recent stock-panic low, which would carry it back up to $23.92 to $35.88, you should be establishing a material portfolio allocation. Maybe that’s 5%, compared to the 10% to 20% every investor should always have deployed in far-less-volatile gold.

And if silver is starting an epic mean-reversion-overshoot bull run higher out of the most-extreme SGR levels ever witnessed by far, the gains coming in the major silver miners’ stocks will dwarf silver’s! They tend to amplify silver’s own moves by an additional 2x to 3x. So about a month ago we started adding new trades in fundamentally-superior silver miners in our newsletters, buying low before they soar far higher.

This new post-panic silver bull’s upside potential is amazing! Silver’s shocking all-time-record low relative to gold is just one factor. Speculators’ extreme silver-futures long purge left them positioned to be huge buyers. And investment buying has already been strong and relentless in the stock panic’s wake. Add gold itself heading way higher on big investment buying and near-hyper-inflation, and silver looks incredible.

We do all the hard fundamental stock-picking work at Zeal, winnowing the silver-stock field to uncover the likely big winners. And we’re currently still redeploying in these fundamentally-superior gold and silver stocks as their latest upleg grows, which are recommended in our popular weekly and monthly newsletters. The unrealized gains in our new trades deployed since mid-March are already running up to 60% this week!

To profitably trade high-potential gold and silver stocks, you need to stay informed about broader market cycles driving gold. Our newsletters are a great way, easy to read and affordable. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. Subscribe today and take advantage of our 20%-off sale! Get onboard so you can mirror our great new trades being layered in for silver stocks’ next mighty upleg.

The bottom line is silver is due for an epic mean reversion higher relative to gold in coming years. The recent stock panic obliterated silver prices to their lowest levels ever seen compared to gold! Historically, similar but milder silver-low extremes were soon followed by massive mean-reversion-overshoot bulls. After the last stock panic in late 2008, silver more than quintupled over the next couple years or so.

Silver’s new-bull-market upside potential after this latest stock panic looks considerably bigger. Silver-futures speculators’ mass exodus during the panic gives them vast room to buy back in. And investment-capital inflows have already been strong and relentless in this panic’s wake. Silver should amplify gold’s own post-stock-panic bull on surging investment demand for prudent diversification and on Fed-inflation fears.