- Source, Ron Paul

TRACKING THE GOLD AND SILVER INVESTMENT COMMUNITY, WORLDWIDE - AN UNOFFICIAL EDITING OF RELATED INVESTMENT COMMENTARY

Monday, March 30, 2020

Ron Paul: It Wasn't Different This Time... It Was Worse and The Fed Will Fail

Saturday, March 28, 2020

If Getting Us Into $6 Trillion More Debt Doesn’t Matter, Then Why Not $350 Trillion?

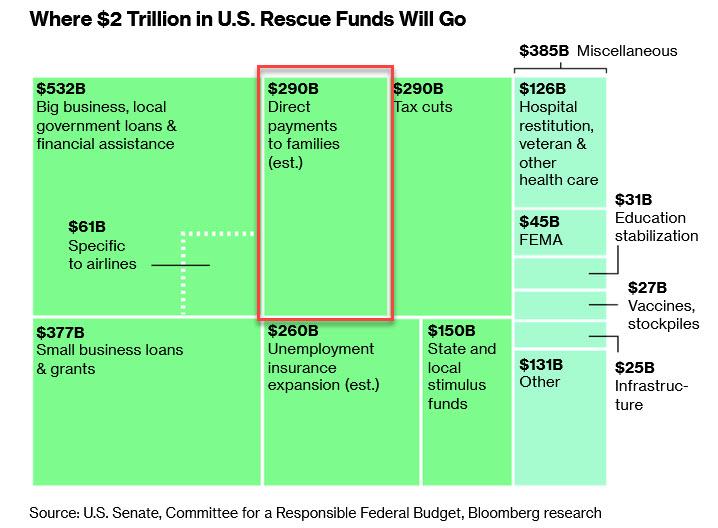

Shortly after 4pm on Friday, president Trump signed into law the $2 trillion fiscal stimulus also known as the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), which gives the Fed the ammunition to issue up to $4.5 trillion in additional debt, a "Multitrillion Dollar Helicopter Credit Drop" as Bloomberg called it, and officially launches not only helicopter money but the biggest wealth transfer in US history, as not only will the Fed balance sheet double on short notice but will unleash an unprecedented spending spree the likes of which not even Alexandra Ocasio-Cortez could have ever imagined would take place.

One person tried to if not stop it, then at least delay and ask the critical questions that everyone else in Congress should have been asking: why are US citizens, who are supposed to be the sole beneficiaries of this emergency bailout act, just a footnote in the gargantuan bill's deluge of electronic ones and zeroes. That person was Republican Rep. from Kentucky, Thomas Massie, who tried to force a recorded vote on the legislation, i.e., a roll coll, prompting a scramble by House members to come back to Washington to form the required quorum of at least 216 members.

Of course, Massie failed, as the vote passed and was eventually signed into law. However, Massie did at least try to bring some much needed attention to what was contained in the bill, and pose some of the key questions that so many others should have asked.

Below are some of his key points:

his bill should have been voted on much sooner in both the Senate and House and it shouldn’t be stuffed full of Nancy Pelosi’s pork- including $25 million for the Kennedy Center, grants for the National Endowment for the Humanities and Arts, and millions more other measures that have no direct relation to the Coronavirus Pandemic. That $25 million, for example, should go directly to purchasing test kits. The number one priority of this bill should have been to expand testing availability and creation of tests so that every American, not just the wealthy and privileged, have access to testing. We have shut down the world’s economy without adequate data. Everyone, even those with no symptoms, needs immediate access to a test.

Of course, to quote none other than Nancy, "we have to pass the bill to find out what's in it", and we are confident that in just a few months, everyone will find out precisely why the bill was so rushed: because out of the $2 trillion, only $290 billion is meant for direct payments to families, which as a reminder was the whole point of the bill.

Massie also pointed out that among the bill's key provisions was the even greater entrenchment of Fed secrecy, a Fed which in theory is there to serve the people yet which has successfully defended against an open audit for over a decade:

This bill creates even more secrecy around a Federal Reserve that still refuses to be audited. It allows the Federal Reserve to make decisions about who gets what, how much money we’ll print. With no transparency.

Massie was referring to the fact that the bill repeals the sunshine law for the Fed’s meetings until the end of the year, or until the President says the coronavirus threat is over, which may very well be never. That, as Wall Street on Parade notes, "could make any FOIA lawsuits to unleash details of what’s going on next to impossible since it has been codified in a federal law." The bill states the following:

SEC. 4009. TEMPORARY GOVERNMENT IN THE SUNSHINE ACT RELIEF. (a) IN GENERAL.—Except as provided in subsection 8 (b), notwithstanding any other provision of law, if the Chairman of the Board of Governors of the Federal Reserve System determines, in writing, that unusual and exigent circumstances exist, the Board may conduct meetings without regard to the requirements of section 552b of title 5, United States Code, during the period beginning on the date of enactment of this Act and ending on the earlier of— (1) the date on which the national emergency concerning the novel coronavirus disease (COVID–19) outbreak declared by the President on March 13, 2020 under the National Emergencies Act (50 20 U.S.C. 1601 et seq.) terminates; or (2) December 31, 2020.

This would also mean that US taxpayer will never learn why they went into debt to the tune of $454 billion, which would then be levered 10x by the Fed to issue up to $4.5 trillion in loans to companies the Fed deems appropriate, if no records are being maintained.

However, Massie's final point that was the punchline:

If getting us into $6 trillion more debt doesn’t matter, then why are we not getting $350 trillion more in debt so that we can give a check of $1 million to every person in the country?

Here the Kentucky Representative hit the bullseye, as this is precisely the endgame. However, since one can't unleash the full $350 trillion overnight without classical economists admitting the truth about what the real nature of this bailout is, it will be done piecemeal with other crises, and other "unprecedented" emergencies emerging in the near future and unlocking the path to what is the real goal of this unprecedented reflationary bailout of the world's most indebted nation. It also indirectly addresses Massie's final point:

This stimulus should go straight to the people rather than being funneled through banks and corporations like this bill is doing. 2 trillion divided by 150 million workers is about $13,333.00 per person. That’s much more than the $1,200 per person check authorized by this bill.

Indeed, the math is simple, and the stimulus isn't going directly to the people for one simple reason: that's not its purpose. Instead, its purpose is to not only provide trillions in corporate welfare, but to greenlight self-reinforcing helicopter money whereby the Treasury will now have to issue trillions and trillions in debt and the Fed will have to monetize it or else interest rates will explode.

Of course, this arrangement may prompt other questions, like for example "why pay taxes if the Treasury can just print whatever debt it needs, and the Fed can just buy it", something we have said for over a decade, but we will leave that particular train of thought to another enterprising politician to address... and be ridiculed.

And in case anyone still hasn't figured it out, the whole "republican, democrat" split of the population in two rival camps is nothing more than theater meant to distract while those in control loot not only the here and now, but also rob the future generations blind. Because the sad truth is that behind the fake veneer of either progressive ideals of conservative values, politicians on both sides have one simple directive: to perpetuate the broken status quo for as long as humanly possible, and get as rich as possible in the process.

One person tried to if not stop it, then at least delay and ask the critical questions that everyone else in Congress should have been asking: why are US citizens, who are supposed to be the sole beneficiaries of this emergency bailout act, just a footnote in the gargantuan bill's deluge of electronic ones and zeroes. That person was Republican Rep. from Kentucky, Thomas Massie, who tried to force a recorded vote on the legislation, i.e., a roll coll, prompting a scramble by House members to come back to Washington to form the required quorum of at least 216 members.

Of course, Massie failed, as the vote passed and was eventually signed into law. However, Massie did at least try to bring some much needed attention to what was contained in the bill, and pose some of the key questions that so many others should have asked.

Below are some of his key points:

his bill should have been voted on much sooner in both the Senate and House and it shouldn’t be stuffed full of Nancy Pelosi’s pork- including $25 million for the Kennedy Center, grants for the National Endowment for the Humanities and Arts, and millions more other measures that have no direct relation to the Coronavirus Pandemic. That $25 million, for example, should go directly to purchasing test kits. The number one priority of this bill should have been to expand testing availability and creation of tests so that every American, not just the wealthy and privileged, have access to testing. We have shut down the world’s economy without adequate data. Everyone, even those with no symptoms, needs immediate access to a test.

Of course, to quote none other than Nancy, "we have to pass the bill to find out what's in it", and we are confident that in just a few months, everyone will find out precisely why the bill was so rushed: because out of the $2 trillion, only $290 billion is meant for direct payments to families, which as a reminder was the whole point of the bill.

Massie also pointed out that among the bill's key provisions was the even greater entrenchment of Fed secrecy, a Fed which in theory is there to serve the people yet which has successfully defended against an open audit for over a decade:

This bill creates even more secrecy around a Federal Reserve that still refuses to be audited. It allows the Federal Reserve to make decisions about who gets what, how much money we’ll print. With no transparency.

Massie was referring to the fact that the bill repeals the sunshine law for the Fed’s meetings until the end of the year, or until the President says the coronavirus threat is over, which may very well be never. That, as Wall Street on Parade notes, "could make any FOIA lawsuits to unleash details of what’s going on next to impossible since it has been codified in a federal law." The bill states the following:

SEC. 4009. TEMPORARY GOVERNMENT IN THE SUNSHINE ACT RELIEF. (a) IN GENERAL.—Except as provided in subsection 8 (b), notwithstanding any other provision of law, if the Chairman of the Board of Governors of the Federal Reserve System determines, in writing, that unusual and exigent circumstances exist, the Board may conduct meetings without regard to the requirements of section 552b of title 5, United States Code, during the period beginning on the date of enactment of this Act and ending on the earlier of— (1) the date on which the national emergency concerning the novel coronavirus disease (COVID–19) outbreak declared by the President on March 13, 2020 under the National Emergencies Act (50 20 U.S.C. 1601 et seq.) terminates; or (2) December 31, 2020.

This would also mean that US taxpayer will never learn why they went into debt to the tune of $454 billion, which would then be levered 10x by the Fed to issue up to $4.5 trillion in loans to companies the Fed deems appropriate, if no records are being maintained.

However, Massie's final point that was the punchline:

If getting us into $6 trillion more debt doesn’t matter, then why are we not getting $350 trillion more in debt so that we can give a check of $1 million to every person in the country?

Here the Kentucky Representative hit the bullseye, as this is precisely the endgame. However, since one can't unleash the full $350 trillion overnight without classical economists admitting the truth about what the real nature of this bailout is, it will be done piecemeal with other crises, and other "unprecedented" emergencies emerging in the near future and unlocking the path to what is the real goal of this unprecedented reflationary bailout of the world's most indebted nation. It also indirectly addresses Massie's final point:

This stimulus should go straight to the people rather than being funneled through banks and corporations like this bill is doing. 2 trillion divided by 150 million workers is about $13,333.00 per person. That’s much more than the $1,200 per person check authorized by this bill.

Indeed, the math is simple, and the stimulus isn't going directly to the people for one simple reason: that's not its purpose. Instead, its purpose is to not only provide trillions in corporate welfare, but to greenlight self-reinforcing helicopter money whereby the Treasury will now have to issue trillions and trillions in debt and the Fed will have to monetize it or else interest rates will explode.

Of course, this arrangement may prompt other questions, like for example "why pay taxes if the Treasury can just print whatever debt it needs, and the Fed can just buy it", something we have said for over a decade, but we will leave that particular train of thought to another enterprising politician to address... and be ridiculed.

And in case anyone still hasn't figured it out, the whole "republican, democrat" split of the population in two rival camps is nothing more than theater meant to distract while those in control loot not only the here and now, but also rob the future generations blind. Because the sad truth is that behind the fake veneer of either progressive ideals of conservative values, politicians on both sides have one simple directive: to perpetuate the broken status quo for as long as humanly possible, and get as rich as possible in the process.

- Source, Zero Hedge

Friday, March 27, 2020

Ron Paul: The Coronavirus Profiteers

Crony capitalists, corporate criminals, Keynesians, big brother government advocates, previously unknown minor county officials...there is plenty of profit to go around.

- Source, Ron Paul

Wednesday, March 25, 2020

Is China Attempting to Accelerate the Bankruptcy Of the United States?

What will become of our jobs, our homes, our earnings and savings, our investments and pensions, our retirement accounts, our freedoms, and our society, now and in the future?

What can we do to protect ourselves and our families? Jerry Robinson, economist, trend-trading coach, and author of “Bankruptcy of Our Nation,” returns to Liberty and Finance / Reluctant Preppers to share his analysis of our convulsing economic landscape, and what we can do to live and prosper in it.

- Source, Reluctant Preppers

Deflation Nation: Gold and Silver Coronavirus Market Update

Get an inside look at what this short-term deflation could mean for you, your family and your country in today’s update from Mike.

- Source, Mike Maloney

Tuesday, March 24, 2020

The Gold Market is Breaking Down: Gold Premiums Explode as LBMA Warns of Liquidity Crisis

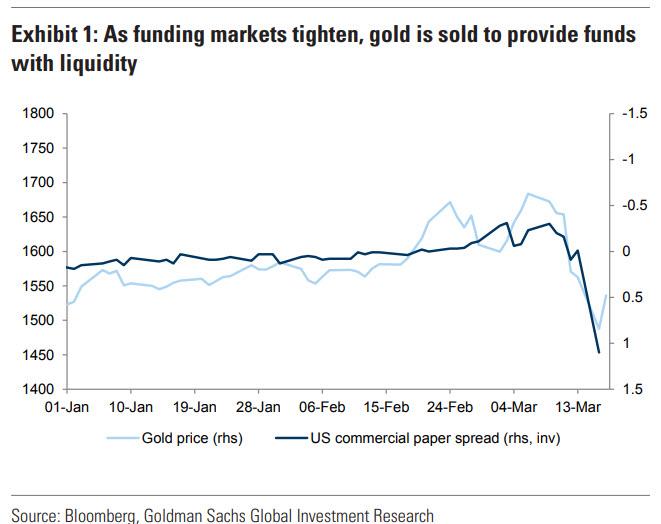

Last night, when observing the unprecedented "gold run" on precious metals dealers which has left all gold vendors with little to no physical gold, we said that "the price of physical gold has decoupled from paper gold" as a result of paper gold liquidations as leveraged funds scramble to cover margin calls using safe assets...

... resulting in an arbitrage that physical gold buyers, i.e., those who don't have faith in gold ETFs such as the GDX or simply prefer to have possession of the metal, find especially delightful as it allows them to buy physical gold at lower prices than they would ordinarily have access to.

However, we also noted that whereas in the past such conditions were self-correcting, this time it is not only a record surge in demand for physical gold but also a near shut down in supply as the most productive gold refiners, those located in the southern Swiss town of Ticina, namely Valcambi, Pamp and Argor-Heraeus, now appear to be offline indefinitely.

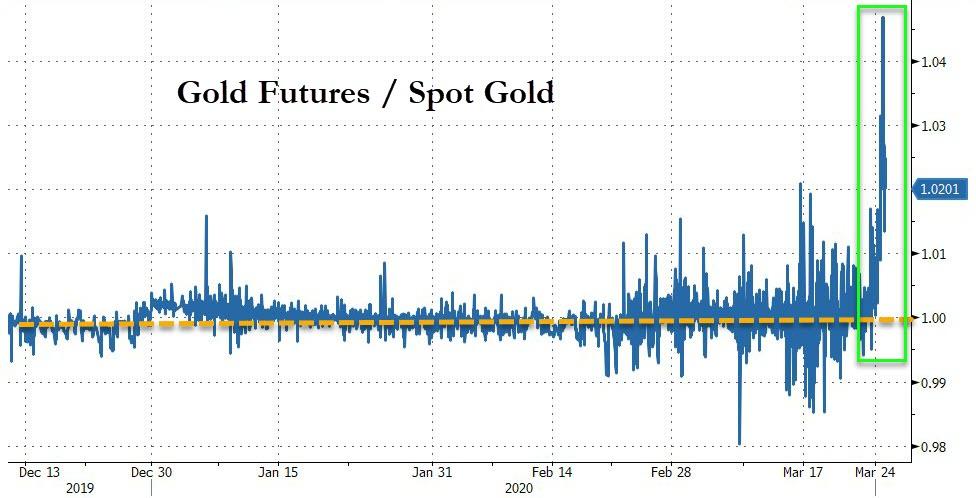

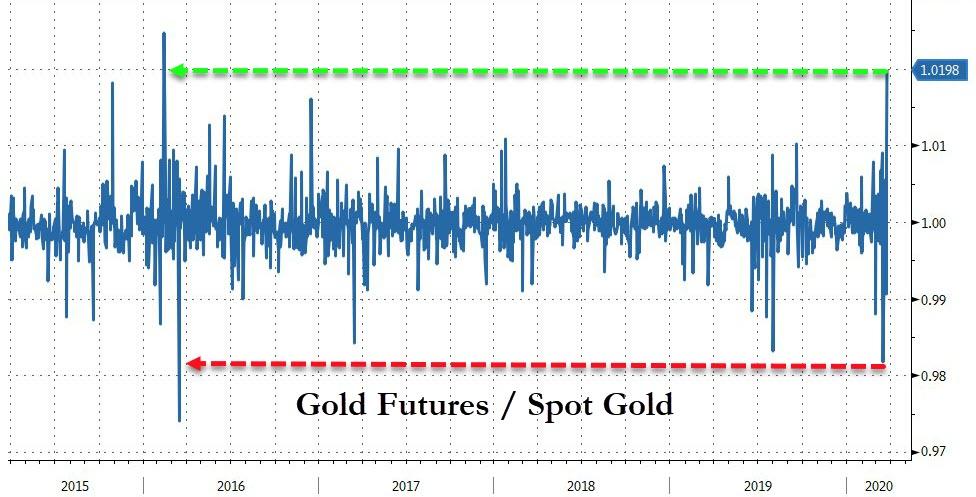

The result is that the spot/futures price divergence discussed last night and further described here, has exploded...

... and on Tuesday morning the divergence that was barely noticeable late Monday has blown out to unprecedented level, with gold futures decoupling and trading far above spot prices.

The near record spread is the widest seen in four years.

As Kitko notes, just before noon EDT, one price vendor was showing spot metal was trading at $1,612.10 an ounce while at the same time showing the Comex April futures were at $1,654.10 an ounce – a spread of $42 an ounce. It was much wider earlier in the day, when as Kitco adds, "nearby futures were more expensive than deferred, a sign of strong demand in any commodity market."

"I’ve never seen that before," said one gold trader who has been in the market for 30-plus years. Some contacts reached by Kitco suggested the discrepancy is an evolving story that is still unfolding, with traders trying to figure out what’s happening.

Earlier in the day, the London Bullion Market Association, the world's most important authority for physical gold and its transfers, issued this stunning statement to Kitco:

"The London gold market continues to be open for business. There has, however, been some impact on liquidity arising from price volatility in Comex 100-oz [ounce] futures contracts. LBMA has offered its support to CME Group to facilitate physical delivery in New York and is working closely with Comex and other key stakeholders to ensure the efficient running of the global gold market."

In short, the unprecedented scramble for physical metal coupled with continued liquidations among levered players, while refiners remains offline, appears to be fracturing the gold market from within.

Saxo Bank's head of commodity strategy, Ole Hansen, observed that a lockdown is occurring in two biggest gold hubs in the world, New York and London, so many traders are working from home. "This has caused a breakdown in the marketplace", he said.

“There is no price discovery in the market right now,” he said Tuesday morning. “If you need to borrow gold in the OTC [over-the-counter] markets right now, you are going to pay a king’s ransom.”

Picking up on what we said last night, Hansen described the problem as a logistics issue as the coronavirus has decimated supply chains across the world, adding that the gold market has dried up because nobody has access to physical metal.

“We don’t have enough hands to handle all the demand,” he said. “There is plenty of gold in the market, but it’s not in the right places. Nobody can deliver the gold because we are forced to stay home.”

Or, as we put it yesterday, "If You Haven't Bought Physical Gold Yet, It's Probably Too Late."

Speaking to Kitco, Rhona O’Connell, head of market analysis for EMEA and Asia regions at INTL FCStone, said that dislocation in the gold market is the result of nervous trading in an increasingly thin marketplace. Not only is physical demand picking in London up, but three major Swiss refiners are shutting down operations, which is putting a further squeeze on supply.

"I think the price action we have seen is as simple as people guarding their risks," she said.

O’Connell added that the price difference between North American markets and London markets is also the result of the U.K. market being more of a physical gold market.

“The balance between physical and futures is more geared towards the [over-the-counter] markets in London,” she said.

Speaking to several other traders, Kitco cites Afshin Nabavi, head of trading with MKS, who pointed out that traders from many banks are working from home due to the coronavirus pandemic. Meanwhile, these participants may be trying to limit risk, contributing to the spreads.

Phil Flynn, senior market analyst with at Price Futures Group, suggested some of the reasons for higher futures prices may be because the market is anticipating future demand as a result of all of the quantitative-easing measures and expectations for fiscal stimulus.

“Futures prices may be a leading indicator of what may be a rush into gold,” Flynn said.

* * *

Separately, traders also pointed out that gold futures were in backwardation this morning, with April futures more expensive than the June and December contracts this morning, although that has since reversed with the back months higher again. When nearby are more expensive, the condition is known as backwardation and is the opposite of normal conditions in any commodity market.

During regular times, later months are more expensive due to extra costs such as storage. But when the nearby months are more expensive, this is seen as a sign that traders are paying a premium to get the commodity as soon as possible.

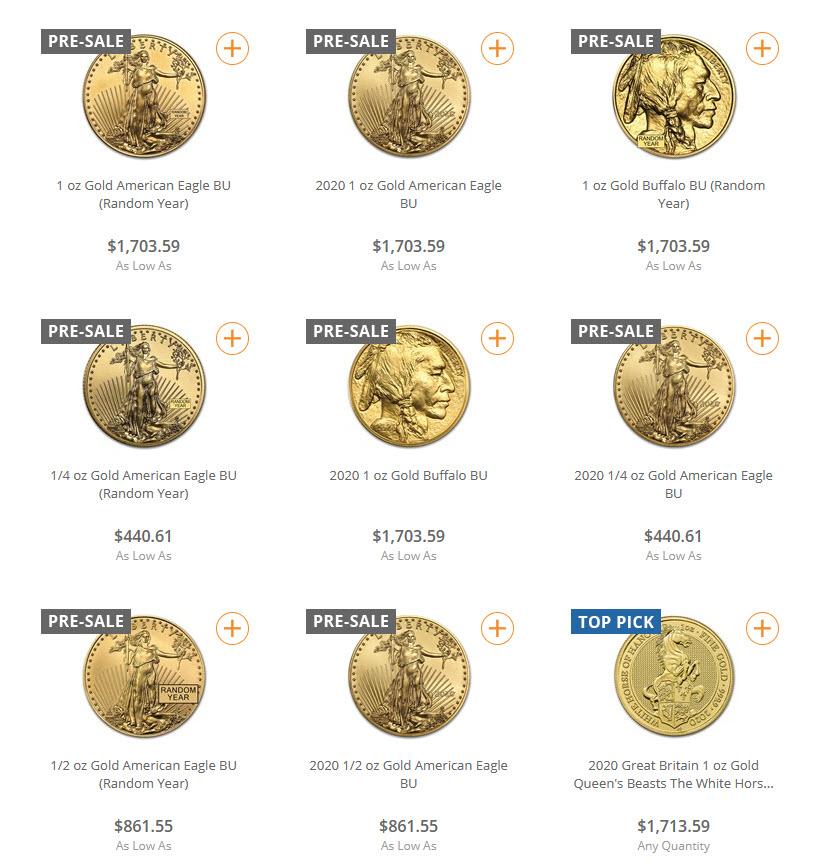

Which anyone who has been to APMEX or any other gold seller in the past few days, has discovered:

"Backwardation shows “there is a lot of demand” with market participants worried about the economy and focusing on the response by governments and central bankers, Flynn said. “People are buying gold like it’s going out of style,” he added.

Or, as we first put it, "It's Selling Like Toilet Paper", which is ironic because thanks to the Fed, Americans are fleeing the toilet paper money known as the dollar, and rushing into real money... as well as actual toilet paper.

... resulting in an arbitrage that physical gold buyers, i.e., those who don't have faith in gold ETFs such as the GDX or simply prefer to have possession of the metal, find especially delightful as it allows them to buy physical gold at lower prices than they would ordinarily have access to.

However, we also noted that whereas in the past such conditions were self-correcting, this time it is not only a record surge in demand for physical gold but also a near shut down in supply as the most productive gold refiners, those located in the southern Swiss town of Ticina, namely Valcambi, Pamp and Argor-Heraeus, now appear to be offline indefinitely.

The result is that the spot/futures price divergence discussed last night and further described here, has exploded...

... and on Tuesday morning the divergence that was barely noticeable late Monday has blown out to unprecedented level, with gold futures decoupling and trading far above spot prices.

The near record spread is the widest seen in four years.

As Kitko notes, just before noon EDT, one price vendor was showing spot metal was trading at $1,612.10 an ounce while at the same time showing the Comex April futures were at $1,654.10 an ounce – a spread of $42 an ounce. It was much wider earlier in the day, when as Kitco adds, "nearby futures were more expensive than deferred, a sign of strong demand in any commodity market."

"I’ve never seen that before," said one gold trader who has been in the market for 30-plus years. Some contacts reached by Kitco suggested the discrepancy is an evolving story that is still unfolding, with traders trying to figure out what’s happening.

Earlier in the day, the London Bullion Market Association, the world's most important authority for physical gold and its transfers, issued this stunning statement to Kitco:

"The London gold market continues to be open for business. There has, however, been some impact on liquidity arising from price volatility in Comex 100-oz [ounce] futures contracts. LBMA has offered its support to CME Group to facilitate physical delivery in New York and is working closely with Comex and other key stakeholders to ensure the efficient running of the global gold market."

In short, the unprecedented scramble for physical metal coupled with continued liquidations among levered players, while refiners remains offline, appears to be fracturing the gold market from within.

Saxo Bank's head of commodity strategy, Ole Hansen, observed that a lockdown is occurring in two biggest gold hubs in the world, New York and London, so many traders are working from home. "This has caused a breakdown in the marketplace", he said.

“There is no price discovery in the market right now,” he said Tuesday morning. “If you need to borrow gold in the OTC [over-the-counter] markets right now, you are going to pay a king’s ransom.”

Picking up on what we said last night, Hansen described the problem as a logistics issue as the coronavirus has decimated supply chains across the world, adding that the gold market has dried up because nobody has access to physical metal.

“We don’t have enough hands to handle all the demand,” he said. “There is plenty of gold in the market, but it’s not in the right places. Nobody can deliver the gold because we are forced to stay home.”

Or, as we put it yesterday, "If You Haven't Bought Physical Gold Yet, It's Probably Too Late."

Speaking to Kitco, Rhona O’Connell, head of market analysis for EMEA and Asia regions at INTL FCStone, said that dislocation in the gold market is the result of nervous trading in an increasingly thin marketplace. Not only is physical demand picking in London up, but three major Swiss refiners are shutting down operations, which is putting a further squeeze on supply.

"I think the price action we have seen is as simple as people guarding their risks," she said.

O’Connell added that the price difference between North American markets and London markets is also the result of the U.K. market being more of a physical gold market.

“The balance between physical and futures is more geared towards the [over-the-counter] markets in London,” she said.

Speaking to several other traders, Kitco cites Afshin Nabavi, head of trading with MKS, who pointed out that traders from many banks are working from home due to the coronavirus pandemic. Meanwhile, these participants may be trying to limit risk, contributing to the spreads.

Phil Flynn, senior market analyst with at Price Futures Group, suggested some of the reasons for higher futures prices may be because the market is anticipating future demand as a result of all of the quantitative-easing measures and expectations for fiscal stimulus.

“Futures prices may be a leading indicator of what may be a rush into gold,” Flynn said.

* * *

Separately, traders also pointed out that gold futures were in backwardation this morning, with April futures more expensive than the June and December contracts this morning, although that has since reversed with the back months higher again. When nearby are more expensive, the condition is known as backwardation and is the opposite of normal conditions in any commodity market.

During regular times, later months are more expensive due to extra costs such as storage. But when the nearby months are more expensive, this is seen as a sign that traders are paying a premium to get the commodity as soon as possible.

Which anyone who has been to APMEX or any other gold seller in the past few days, has discovered:

"Backwardation shows “there is a lot of demand” with market participants worried about the economy and focusing on the response by governments and central bankers, Flynn said. “People are buying gold like it’s going out of style,” he added.

Or, as we first put it, "It's Selling Like Toilet Paper", which is ironic because thanks to the Fed, Americans are fleeing the toilet paper money known as the dollar, and rushing into real money... as well as actual toilet paper.

- Source, Zero Hedge

Will the Panic be More Deadly Than The Virus?

The Great Panic of 2020 is already one for the history books.

Yet the damage has only just begun. We suspect the stock market crash, economic destruction, and forfeiture of freedoms will persist long after the coronavirus hobgoblin has been put to bed.

With respect to the stock market, the modus operandi of the last 11 years is being stood on its head. Rather than ‘buy the dip.’ The new divine mantra is ‘sell the rip.’ Here’s why…

If you recall, the U.S. stock market commenced a multi-year swan dive in autumn of 1929. About that time, the economy also commenced a decade long Great Depression. Given the rapid and relentless stock market carnage over the last month, and the prospect of a lengthy depression, a closer look is in order.

From September 3, 1929 to November 13, 1929, the Dow Jones Industrial Average (DJIA) lost 48.9 percent. Then, as rarely noted, it rallied 48.1 percent through April 17, 1930. This had the adverse effect of luring the buy the dip crowd back into the stock market just in time for the next massacre.

The 1929 through 1932 bear market, as noted by Pater Tenebrarum, was like a rubber ball bouncing down stairs. With each bounce, even the most savvy of investors were given another chance to lose their money. Taken in sequence, the repeated bounces provided many opportunities to lose money over and over again.

In the end, the bounce up between November 13, 1929 and April 30, 1930, turned out to be the ultimate sucker’s rally. The DJIA subsequently crashed 89.2 percent from its initial peak, along with the hopes, dreams, and aspirations of an entire generation.

Such a colossal collapse could never, ever happen again, right?

Well, if it happened before, by definition, it could happen again. Hence, if an interim bottom is put in over the next several weeks, and the DJIA attempts to retrace towards its February 12 all-time closing high, take this as a gift. An opportunity to sell the rip.

Bend the Curve

The economy’s being fundamentally pummeled by coronavirus containment. Long term damage will be sustained. The type of damage that takes a decade – or more – to recover from. Fake money won’t fix it. But, nonetheless, there’s no shortage of solutions being offered to save us from ourselves.

Coronavirus, according to scientific prophecy, spreads exponentially. The only way to contain it is to “flatten the curve” through “social distancing.” The world must “hunker down” in unison; if not voluntarily, by government decree.

Bars, restaurants, gyms, schools, and many employers are shutting down. San Francisco has ordered all residents to “shelter in place.” The Maltese Falcon can only screech to itself from within a vacant John’s Grill.

The former Mayor of San Francisco, and now California Governor, Gavin Newsom, has ordered all residents to stay at home until further notice. According to Newsom, “We need to bend the curve in the state of California.”

Perhaps these solutions have merit. But they’re disastrous for the economy. Cash flows are running dry. Credit markets are freezing up. People are losing their jobs. Full mobilization is needed, we’re told, in the war on coronavirus.

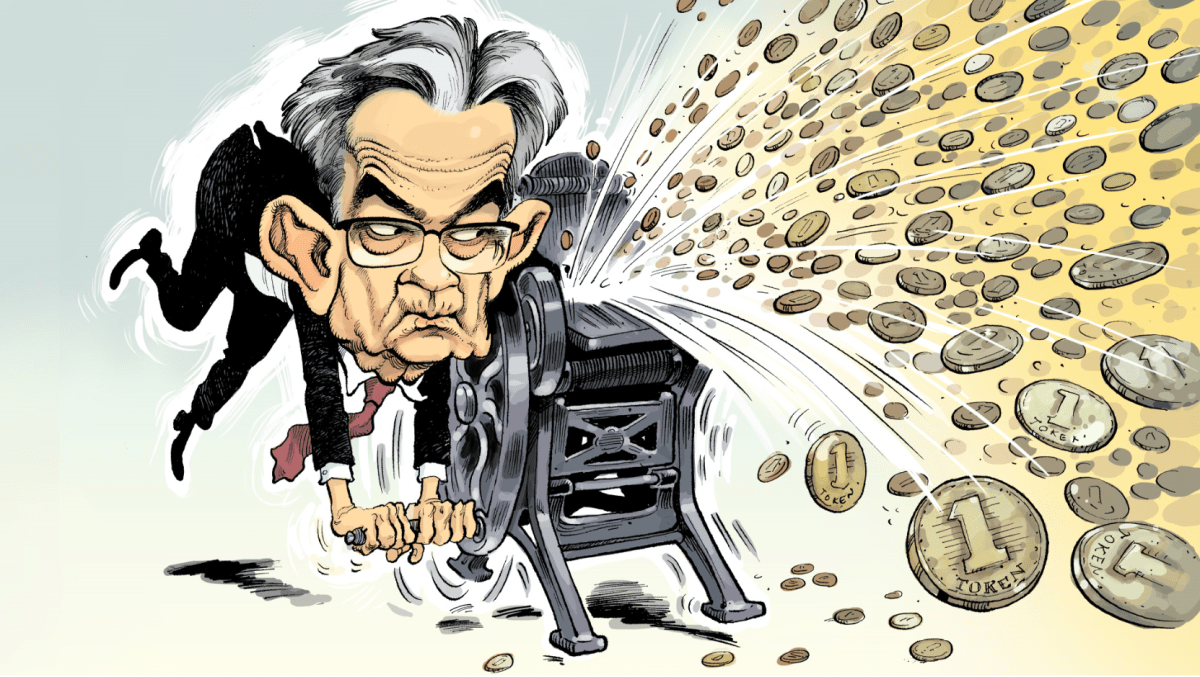

For example, Fed Chairman Jay Powell’s pulling out all the monetary stops – zero interest rate policies, quantitative easing, repo madness – to pump liquidity into credit markets. But that’s not all…

The Fed’s now accepting stocks as collateral in exchange for liquidity. The Fed also established a Money Market Mutual Fund Liquidity Facility (MMLF). The sole intent of the MMLF is to keep short-term credit markets from frosting over like the Alaskan tundra, and breaking the buck.

On the fiscal side, the Treasury Department’s angling with Congress to send out $1,000 checks – possibly, two of them – to struggling Americans. Mitt Romney, a man of discretion, is onboard with $1,000 checks. Chuck Schumer says it won’t be enough. Cory Booker wants to send out $4,500 checks.

But why stop there? Why not send out $45,000 checks? If a little helicopter money’s good, isn’t more always better?

Is the Panic Worse than the Virus?

If only the world was as simple as potato brains Booker believes. Remember, when the U.S. Treasury borrows money created out of thin air from the Fed to send out checks, it’s executing a program of mass currency debasement.

A check may arrive in your mailbox. But its face value constitutes a fraud. Moreover, this fraud constitutes a down payment on tomorrow’s disorder.

Yet, by the doom being proffered on the matter, mass currency debasement and systematic hunkering is needed to win the war on coronavirus and save the economy. Or is it?

For perspective, we’ll draw from words first scribbled in 1841 by Charles MacKay. Here’s a brief excerpt from MacKay’s timeless classic, Extraordinary Popular Delusions and the Madness of Crowds…

“During seasons of great pestilence men have often believed the prophecies of crazed fanatics, that the end of the world was come. Credulity is always greatest in times of calamity. Prophecies of all sorts are rife on such occasions, and are readily believed, whether for good or evil.

“During the great plague, which ravaged all Europe, between the years 1345 and 1350, it was generally considered that the end of the world was at hand. Pretended prophets were to be found in all the principal cities of Germany, France, and Italy, predicting that within ten years the trump of the Archangel would sound, and the Saviour appear in the clouds to call the earth to judgment.”

As far as we can tell, the coronavirus has attracted prophets of all stripes like bees to a honey pot. Mass coronavirus hysteria has led to public and pretend prophetic histrionics.

According to Bill Ackman, “hell is coming.”

Maybe so. Or maybe the mass panic has been slightly overblown. By this, is the panic worse than the virus? Who knows?

What we do know, is the spring equinox has arrived…marking the earliest coming of spring in 124 years. After the last several weeks of winter, we’ll take it.

With respect to the stock market, the modus operandi of the last 11 years is being stood on its head. Rather than ‘buy the dip.’ The new divine mantra is ‘sell the rip.’ Here’s why…

If you recall, the U.S. stock market commenced a multi-year swan dive in autumn of 1929. About that time, the economy also commenced a decade long Great Depression. Given the rapid and relentless stock market carnage over the last month, and the prospect of a lengthy depression, a closer look is in order.

From September 3, 1929 to November 13, 1929, the Dow Jones Industrial Average (DJIA) lost 48.9 percent. Then, as rarely noted, it rallied 48.1 percent through April 17, 1930. This had the adverse effect of luring the buy the dip crowd back into the stock market just in time for the next massacre.

The 1929 through 1932 bear market, as noted by Pater Tenebrarum, was like a rubber ball bouncing down stairs. With each bounce, even the most savvy of investors were given another chance to lose their money. Taken in sequence, the repeated bounces provided many opportunities to lose money over and over again.

In the end, the bounce up between November 13, 1929 and April 30, 1930, turned out to be the ultimate sucker’s rally. The DJIA subsequently crashed 89.2 percent from its initial peak, along with the hopes, dreams, and aspirations of an entire generation.

Such a colossal collapse could never, ever happen again, right?

Well, if it happened before, by definition, it could happen again. Hence, if an interim bottom is put in over the next several weeks, and the DJIA attempts to retrace towards its February 12 all-time closing high, take this as a gift. An opportunity to sell the rip.

Bend the Curve

The economy’s being fundamentally pummeled by coronavirus containment. Long term damage will be sustained. The type of damage that takes a decade – or more – to recover from. Fake money won’t fix it. But, nonetheless, there’s no shortage of solutions being offered to save us from ourselves.

Coronavirus, according to scientific prophecy, spreads exponentially. The only way to contain it is to “flatten the curve” through “social distancing.” The world must “hunker down” in unison; if not voluntarily, by government decree.

Bars, restaurants, gyms, schools, and many employers are shutting down. San Francisco has ordered all residents to “shelter in place.” The Maltese Falcon can only screech to itself from within a vacant John’s Grill.

The former Mayor of San Francisco, and now California Governor, Gavin Newsom, has ordered all residents to stay at home until further notice. According to Newsom, “We need to bend the curve in the state of California.”

Perhaps these solutions have merit. But they’re disastrous for the economy. Cash flows are running dry. Credit markets are freezing up. People are losing their jobs. Full mobilization is needed, we’re told, in the war on coronavirus.

For example, Fed Chairman Jay Powell’s pulling out all the monetary stops – zero interest rate policies, quantitative easing, repo madness – to pump liquidity into credit markets. But that’s not all…

The Fed’s now accepting stocks as collateral in exchange for liquidity. The Fed also established a Money Market Mutual Fund Liquidity Facility (MMLF). The sole intent of the MMLF is to keep short-term credit markets from frosting over like the Alaskan tundra, and breaking the buck.

On the fiscal side, the Treasury Department’s angling with Congress to send out $1,000 checks – possibly, two of them – to struggling Americans. Mitt Romney, a man of discretion, is onboard with $1,000 checks. Chuck Schumer says it won’t be enough. Cory Booker wants to send out $4,500 checks.

But why stop there? Why not send out $45,000 checks? If a little helicopter money’s good, isn’t more always better?

Is the Panic Worse than the Virus?

If only the world was as simple as potato brains Booker believes. Remember, when the U.S. Treasury borrows money created out of thin air from the Fed to send out checks, it’s executing a program of mass currency debasement.

A check may arrive in your mailbox. But its face value constitutes a fraud. Moreover, this fraud constitutes a down payment on tomorrow’s disorder.

Yet, by the doom being proffered on the matter, mass currency debasement and systematic hunkering is needed to win the war on coronavirus and save the economy. Or is it?

For perspective, we’ll draw from words first scribbled in 1841 by Charles MacKay. Here’s a brief excerpt from MacKay’s timeless classic, Extraordinary Popular Delusions and the Madness of Crowds…

“During seasons of great pestilence men have often believed the prophecies of crazed fanatics, that the end of the world was come. Credulity is always greatest in times of calamity. Prophecies of all sorts are rife on such occasions, and are readily believed, whether for good or evil.

“During the great plague, which ravaged all Europe, between the years 1345 and 1350, it was generally considered that the end of the world was at hand. Pretended prophets were to be found in all the principal cities of Germany, France, and Italy, predicting that within ten years the trump of the Archangel would sound, and the Saviour appear in the clouds to call the earth to judgment.”

As far as we can tell, the coronavirus has attracted prophets of all stripes like bees to a honey pot. Mass coronavirus hysteria has led to public and pretend prophetic histrionics.

According to Bill Ackman, “hell is coming.”

Maybe so. Or maybe the mass panic has been slightly overblown. By this, is the panic worse than the virus? Who knows?

What we do know, is the spring equinox has arrived…marking the earliest coming of spring in 124 years. After the last several weeks of winter, we’ll take it.

- Source, Silver Bear Cafe

Monday, March 23, 2020

Is Printing Money the Answer to Avoiding Financial Ruin?

In this episode, Johanna Botta discusses how the central banks could use Modern Monetary Theory to help recover the world’s economy. With Coronavirus continuing to cause financial damage across the globe, is printing money our best option?

- Source, Real Vision

Saturday, March 21, 2020

Physical is King: Silver Prices Plummet as Mints Can’t Keep up With Demand

“I can tell you one thing, I called around the last couple of days trying to buy physical metals, specifically physical silver, and silver was a $1.50 to $2.00 over spot, so there is an underlying demand that is out there right now, just more on the physical side,” Streible told Kitco News.

- Source, Kitco News

Wednesday, March 18, 2020

Monday, March 16, 2020

QE to Infinity: Schumer Proposes $750 Billion To Wage War On Coronavirus

The Senate may want to amend the House's Phase Two coronavirus bill and not pass it immediately, according to Politico.

The deal, cut between Nancy Pelosi and Treasury Secretary Steven Mnuchin is unlikely to make it through in its current form, according to senior Senate GOP sources, who say that Senate Majority Leader Mitch McConnell and his chamber are going to insist on a much bigger say in the next stimulus package.

"It doesn't go far enough and it doesn't go fast enough," said Republican Sen. Tom Cotton of Arkansas, who predicted Monday on Fox & Friends that the House coronavirus bill wouldn't pass the Senate.

"Most of the measures in this bill are something that the senators will support, I believe. ... But we worry that the bill setting up a new and complicated system relying on businesses giving paid sick leave and then getting a refundable tax credit that won't move quickly enough and could put pressure on those businesses to lay workers off," Cotton added.

Meanwhile, Rep. Louie Gohmert (R-TX) "has signaled he will insist on approving the corrections to the bill, or else he will object to the unanimous consent request in the House," which Politico says "would grind this process to a halt."

Earlier in the day, Politico reported that the bill remained "hung up in negotiations" amid "major differences" after the Senate canceled its week-long recess to address the COVID-19 pandemic.

House sources said Monday that "major differences" remained between the White House and House Democrats over what was adopted and needed to be changed. This is slowing down the time table for House completion of the bill and sending it onto the Senate.

Pelosi and administration officials still remain hopeful they can achieve a workable compromise, but were tight lipped about the state of play on Monday.

The House passed its emergency package early Saturday morning but needs to make some technical corrections. -Politico

Senate Majority Whip John Thune (R-SD) is asking members to submit their own ideas for an additional stimulus package by noon on MOnday, according to a Senate aide.

On Tuesday, Mnuchin is expected to attend the Senate Republican lunch - implying he may need to schmooze to sell the deal.

"It doesn't go far enough and it doesn't go fast enough," said Republican Sen. Tom Cotton of Arkansas, who predicted Monday on Fox & Friends that the House coronavirus bill wouldn't pass the Senate.

"Most of the measures in this bill are something that the senators will support, I believe. ... But we worry that the bill setting up a new and complicated system relying on businesses giving paid sick leave and then getting a refundable tax credit that won't move quickly enough and could put pressure on those businesses to lay workers off," Cotton added.

Meanwhile, Rep. Louie Gohmert (R-TX) "has signaled he will insist on approving the corrections to the bill, or else he will object to the unanimous consent request in the House," which Politico says "would grind this process to a halt."

Earlier in the day, Politico reported that the bill remained "hung up in negotiations" amid "major differences" after the Senate canceled its week-long recess to address the COVID-19 pandemic.

House sources said Monday that "major differences" remained between the White House and House Democrats over what was adopted and needed to be changed. This is slowing down the time table for House completion of the bill and sending it onto the Senate.

Pelosi and administration officials still remain hopeful they can achieve a workable compromise, but were tight lipped about the state of play on Monday.

The House passed its emergency package early Saturday morning but needs to make some technical corrections. -Politico

Senate Majority Whip John Thune (R-SD) is asking members to submit their own ideas for an additional stimulus package by noon on MOnday, according to a Senate aide.

On Tuesday, Mnuchin is expected to attend the Senate Republican lunch - implying he may need to schmooze to sell the deal.

- Source, Zero Hedge

Sunday, March 15, 2020

Why isn’t Gold at $2000 When Global Economy is Melting Down?

- Source, Kitco News

Friday, March 13, 2020

Gold & Silver Update: Stock Market Chaos, Virus Recession?

- Source, Golden Rule Radio

Wednesday, March 11, 2020

The Worst Investment in Pension Fund History...

When asked to run for Orange County Treasurer-Tax Collector, who at the time was Robert Citron, he shocked to discover that the portfolio Citron managed was highly levered.

This compelled Senator Moorlach to run, which marked the beginning of his transition into public office.

- Source, Real Vision Finance

Monday, March 9, 2020

Investors book profits after gold hits seven year high on virus worries

Gold prices hit a more than seven-year high on Monday as a stock market rout on concerns over the widening coronavirus outbreak and its economic impact drove investors to safe-haven assets, although profit taking later unwound much of the metal's rise.

In a volatile session, spot gold touched its highest since December 2012 at $1,702.56 before being knocked back to stand 0.5% lower at $1,665.68 per ounce by 0926 GMT. U.S.gold futures shed 0.4% to $1,666.

"Traders had put $1,700 as their (price) target, so there was a lot profit-taking once that target was reached," said Avtar Sandu, a seniorcommodities manager at Phillip Futures.

He added that part of the selling was because of the need to meet margin calls as the fast-spreading virus landed a sharp blow on global equities.

Jeffrey Halley, a senior market analyst at OANDA, also pointed to a slump in crude oil prices, which sent deflationary shocks through the market, as a cap on bullion's upside.

Losing more than a quarter of their value, oil prices were set for their biggest daily rout since the first Gulf War after Saudi Arabia cut its official prices. Gold is often seen as a hedge against oil-led inflation.

Stock markets were lower across the board, with U.S.stock futures also down 5%, while the Japanese yen jumped to a more than 3-year high against the dollar and U.S. 10-year Treasury yields fell to a record low.

Halley said worse than expected Chinese trade data and Italy's move to quarantine a quarter of its population because of thecoronavirus had helped spook markets and prompt the flight to safety.

Pointing to the impactfrom the virus epidemic, China's exports contracted sharply in the first two months of the year while imports declined, data showed on Saturday.

A Reuters poll showed that the virus, which has now infected more than 110,000 people worldwide, likely halved China's economic growth in the current quarter compared with the previous three months.

In an attempt to contain its owncoronavirus outbreak, Italy ordered a virtual lockdown across much of its wealthy north on Sunday which will impact some 16 million people and stay in force until April 3.

Markets are expecting another rate cut from the U.S. Federal Reserve at its policy meeting on March 18, following last week's emergency easing.

Among other precious metals, silver fell 2.6% to $16.85 per ounce. Palladium fell 7% to $2,388, while platinum was down 3.6 at $868.80.

In a volatile session, spot gold touched its highest since December 2012 at $1,702.56 before being knocked back to stand 0.5% lower at $1,665.68 per ounce by 0926 GMT. U.S.

"Traders had put $1,700 as their (price) target, so there was a lot profit-taking once that target was reached," said Avtar Sandu, a senior

He added that part of the selling was because of the need to meet margin calls as the fast-spreading virus landed a sharp blow on global equities.

Jeffrey Halley, a senior market analyst at OANDA, also pointed to a slump in crude oil prices, which sent deflationary shocks through the market, as a cap on bullion's upside.

Losing more than a quarter of their value, oil prices were set for their biggest daily rout since the first Gulf War after Saudi Arabia cut its official prices. Gold is often seen as a hedge against oil-led inflation.

Stock markets were lower across the board, with U.S.

Halley said worse than expected Chinese trade data and Italy's move to quarantine a quarter of its population because of the

Pointing to the impact

A Reuters poll showed that the virus, which has now infected more than 110,000 people worldwide, likely halved China's economic growth in the current quarter compared with the previous three months.

In an attempt to contain its own

Markets are expecting another rate cut from the U.S. Federal Reserve at its policy meeting on March 18, following last week's emergency easing.

Among other precious metals, silver fell 2.6% to $16.85 per ounce. Palladium fell 7% to $2,388, while platinum was down 3.6 at $868.80.

- Source, Yahoo Finance

Saturday, March 7, 2020

Are You Ready for Communism in America?

- Source, Jay Taylor Media

Friday, March 6, 2020

Sunday, March 1, 2020

Empty Shelves, A Stock Market Crash And Total Lockdown

- Source, Silverdoctors

Subscribe to:

Posts (Atom)