Achuthan, co-founder of the Economic Cycle Research Institute, believes it’s not an ideal environment for sustainable gains.

“All the optimism is really in these risk-on assets,” he said Wednesday on CNBC’s “Trading Nation. ” “When we look to the hard data, we see the slowdown. There is a deceleration in growth that has been going on. It’s continuing actually to occur, and that’s the disconnect here. ”

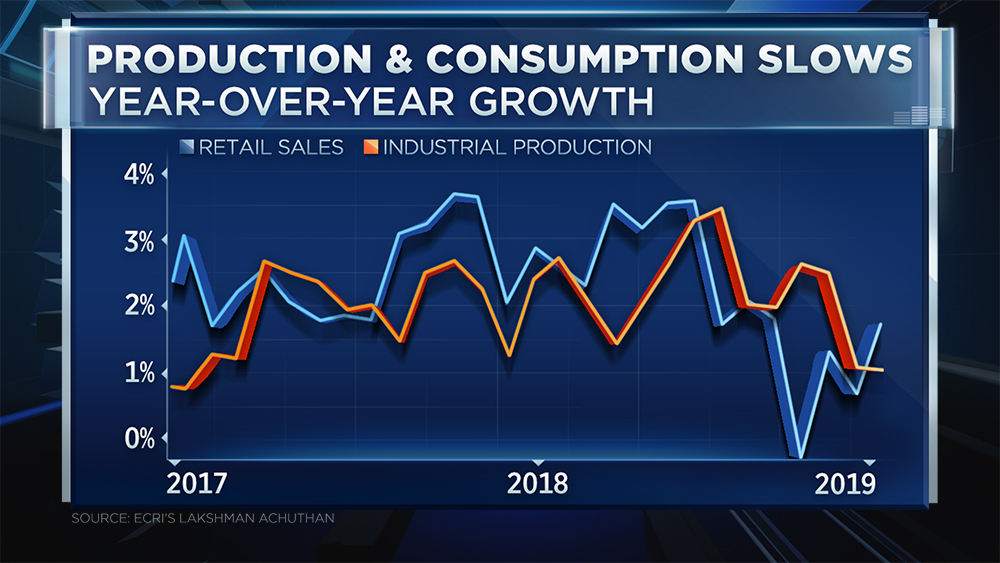

He takes his case a step further by highlighting a chart that shows industrial output and consumption slowdowns. It illustrates that their growth rates turned down in the second half of last year and never materially recovered.

“They both topped out,” said Achuthan. “Retail sales haven’t been this low for the past two years with the exception of the last few months where in December it went to its lowest reading since 2009.”

That decade low coincided with the historic plunge in the stock market.

Since then, the major stock indexes are up 22% to 25%. The Dow and S&P 500 closed at all-time highs on Tuesday, and the Nasdaq hit an intraday record high on Wednesday. However, the industrial production and retail sales failed to follow suit.

“Is it all of the sudden going to reaccelerate back up to where the market hopes it will be or not?” he asked. “It’s pretty low at this moment because this hard data and this stuff weigh from the risk-on kind of feeling hasn’t shown up.”

According to Achuthan, the Street is largely making a faith-based forecast that economic growth will rebound in the year’s second half. It’s an assumption that could generate a lot of pain, he suggests. He contends the market isn’t in the clear from another sharp pullback.

“Corrections happen during growth-rate cycle slowdowns,” Achuthan said. “They don’t require a recession."

- Source, CNBC