Despite Friday’s dip, gold prices continued to hold firm above the October lows as the sideways drifting trend for gold continues against a backdrop of strong global equity markets and a rising crude oil price. The gold bulls are clearly gathering their strength for an attempt at regaining control of the short-term trend. In this commentary we’ll examine the prospects for their success.

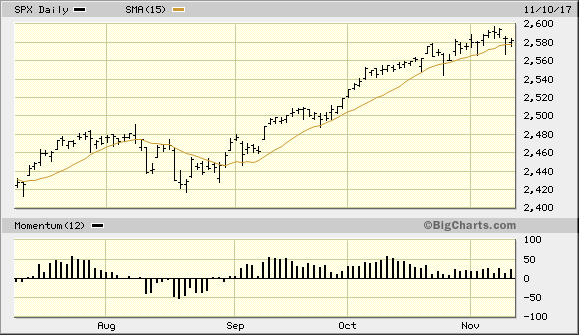

Asia stocks hovered near a 10-year high late last week following record-breaking highs on Wall Street earlier in the week. However, U.S. equities showed signs of profit-taking on Thursday and Friday as the S&P 500 Index (SPX) dipped temporarily below the 15-day moving average before rallying to close above it (see chart below). Further weakness in the equity market would be a blessing in disguise for gold, as it would give the bulls something to rally around. It would almost certainly focus the attention of nervous investors back on the safe havens, making gold a logical choice to park their cash in the event of a stock market pullback.

Meanwhile in Washington, a Senate tax-cut bill, differing from one in the House of Representatives, was unveiled on Thursday. The Senate’s version of the bill calls for delaying a tax cut in the corporate tax rate by one year. It also differs from the House version in several other key areas, including property tax, mortgage interest, and medical expense deductions. The two chambers will have to resolve their differences in order to receive the president's approval. The Senate's version of the bill frustrates a Republican push to overhaul the federal tax code, and many observers expressed doubt over Congress' ability to arrive at a consensus.

- Source, Seeking Alpha