Silver solidly punched through and closed above the 50 day moving average on Friday. Today looks to be a gap-up at the open. Silver can

Then, there’s the bullish performance and momentum since last Friday, as show in the 3

Adding momentum to the rally could be the pandemonium and chaos caused by the Bitcoin hard fork tomorrow. Between suspended accounts and uncertainty, silver is set to shine brightly. Look

Last week most major market indexes hit new all-time highs last week. Seems harder and harder to go only up and up. Usually if someone keeps blowing air into a balloon, at a point it will pop. No graph needed, cause well, we have seen those new highs again and again and again.

Crude

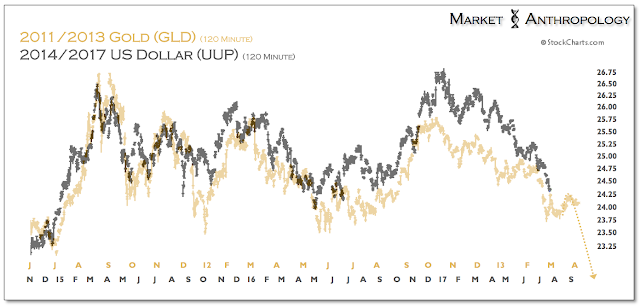

And finally, for the US dollar, things have not been looking good since last week, and with the strength in gold and silver, and the uncertainty in the cryptos, this is not looking good for the greenback. For now, it seems bullion is bid and the dollar is bust:

Looks like it is going to be a great week to be a silverbug!

- Source, The Silver Doctors